And the reality of 2023 is happening just like that. After the strong rally in December 2022, the price of gold in the first week of January 2023 increased so strongly that it was half of the increase that BullionVault survey respondents predicted for the price of gold in 2023 (the survey was carried out in December 2022).

Prices also continued their uptrend, despite strong jobs data in the US – supporting the Federal Reserve’s (Fed) commitment to continue raising interest rates through 2023. In just the first 10 days of 2023, Silver prices have grown by two-thirds of what BullionVault survey respondents predict for silver prices in 2023.

Meanwhile, platinum is the only precious metal that has fallen in price in the first 10 days of this year, contrary to predictions of about 10% increase in 2023. But palladium has outperformed predictions despite just entering 2023 half a month.

The movements of gold, silver and platinum prices since the beginning of the year are also the basis for professional analysts to make their own forecasts.

But, while silver prices at the end of 2022 have barely increased compared to the beginning of the year, gold prices have experienced 12 months of extreme volatility before entering 2023.

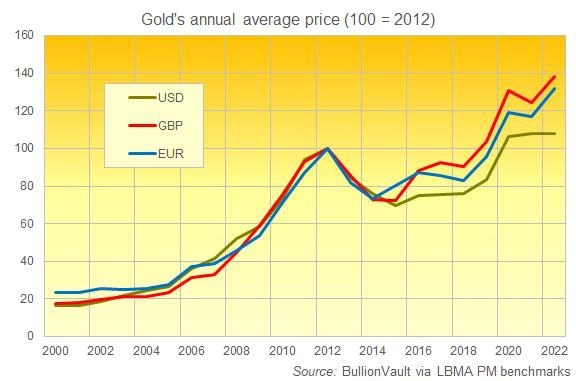

The average gold price last year was the third all-time high. However, silver prices seem to have ended the previous three-year streak of gains.

In euro terms, the gold price in 2022 is on average the fourth highest in history, having reached an all-time high in March 2022, above 1,900 euros per ounce, after Russia launched a campaign especially in Ukraine.

In terms of Japanese yen, the price of gold also surpassed all previous records due to the strong depreciation of the yen in the foreign exchange market. And the weakening of the pound also caused the price of gold in pounds to hit an all-time high as happened when the Covid-19 epidemic first started, in August 2020, at 1,580 GBP/ounce, and the average price The average in 2022 is 11.5% higher than in 2021, reaching 1,458 GBP.

To sum up, the average price of gold in USD terms in the early days of 2023 is only 1.6 USD higher than the high of the previous 12 months.

However, since retaking the $1,800 mark, gold prices have rallied rapidly, showing the metal’s strength despite the biggest interest rate hike since 1980 by the US central bank (then, the Fed).

But averaging more than $1,800 an ounce for the first time, non-income gold showed superior strength ahead of the biggest U.S. interest rate hike since 1980 (when the Fed, under Paul Volcker’s leadership). President, had “removed inflation from the system” and the price of gold plunged from its all-time high) and long-term US bond yields also surged.

According to one professional bullion trader, that resilience certainly provides the “strongest bullish signal” for gold in 2023.

So what will come in the future?

The results of the BullionVault survey in December showed that more than 1,800 of the respondents fully answered questions about the factors that will affect the price of gold the most. In which, the monetary policy factor is most prominent in promoting the price of gold and other precious metals to increase in 2023 (27.7%), followed by inflation (17.8%), the size of the deficit government budget deficit (16.8%), and then geopolitics.

In fact, 14.4% of respondents see geopolitics as the top driver of gold prices in 2023, down from 18.1 in the July survey, and low significantly higher than the average in surveys over the past 8 years (21.2%).

The predictions of possible 2023 dynamics in the bullion market reflect the reality of 2022.

War, inflation and the stock market plunging over the past year – sounds like the perfect storm for precious metals.

But since physical gold doesn’t yield yields, rising interest rates have had the effect of offsetting those factors.

Gold and silver rallied sharply during a period of record high inflation. However, inflation has cooled, although still close to multi-decade highs. So central bank interest rates, if not bond market prices, are also likely to continue to rise a little further, led of course by the Fed, despite the obvious threat and current of a deep global recession.

With a consensus on stagnant inflation for 2023, it is clear that gold is becoming an important part of many people’s investments again.

According to a BullionVault survey, on average precious metals investors hold nearly four-fifths of their self-invested assets in other assets. So while the top financial worry in 2023 for half of them remains inflation (48.9%), the first rationale they cite for investing in physical gold is in fact is the need to spread risk and diversify its broader portfolio (37.6%), which outweighs the reason for the hot cost of living (34.8%).

Again, the picture for 2022 makes it important to buy gold to fight inflation, because the precious metal works to help investors spread risk and reduce the impact of inflation.

Indeed, a ‘standard’ UK portfolio divided 60% by stocks and 40% by bonds would have yielded only 0.6% per year for the past half-decade, which is the level of performance The worst five years since at least 1970. But just shifting 5% of that portfolio to gold would boost average annual returns by 1.1%.

With things going as they are, fear and doubt across the broad financial markets meant that gold and silver started 2023 with a typical New Year’s bull run, attracting inflows and outflows. speculative capital as traders see weak growth, high inflation and a complicated geopolitical outlook.

However, what this rally has NOT done so far is attract a new wave of Western investment into physical gold.

Gold-backed ETF trusts have little changed in size from early 2023 to now after shrinking over the past year. Many investors were net sellers of gold, and the silver sale was even stronger.

But if this bull run – fueled by hedge funds buying heavily and high import demand into China ahead of the Lunar New Year – doesn’t stop anytime soon, many people’s portfolio diversification will be met difficult because they have to buy gold at an inflated price.

Regardless of what professional analysts think – almost all of them are revising their predictions for the gold price outlook in the new year in the direction of an upward correction. That’s what BullionVault’s survey results show – that everything will do well in 2023, including gold, silver and other precious metals.

Reference: BullionVault

Source: Vietnam Insider