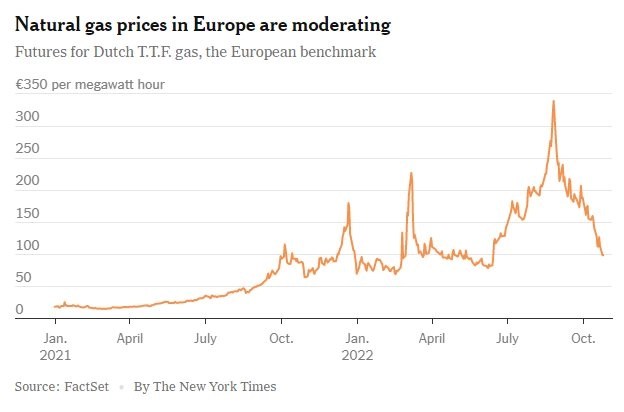

The conflict between Russia and Ukraine shows no sign of ending, Russia’s natural gas exports to Europe are dwindling and winter is approaching. These are inherently strong bullish signals. But the price of gas, which is vitally important for heating homes and powering power plants and industry, is plummeting.

European gas prices rose above 340 euros ($332.6/MGh at the end of August), but this week fell below 100 euros for the first time since Russia cut supply before the conflict, its price is as low as 30 euros So why is there such a 70% reduction?

One of the reasons prices have plummeted is that Europe already has enough of the natural gas it needs. Over the summer, Europe ramped up its purchases of gas from around the world after its longtime main supplier Russia reduced its natural gas output.

Across the continent, governments and businesses have been actively adding to their gas reserves. At the urging of European Union officials and rising costs, the stockpile has been filled to 93% of capacity compared with less than 80% annually.

The biggest reason is that the US is exporting a large amount of LNG to Europe, but the large number of tankers waiting to be unloaded at European ports are congested because they cannot handle large volumes of shipments.

There are 641 LNG vessels in service in the world, and 60 of them are awaiting fuel discharge in Europe. According to MarineTraffic, these LNG carriers have been idling or slowly circling Northwestern Europe, the Mediterranean, and the Iberian Peninsula. One is anchored in the Suez Canal and eight LNG ships from the US are underway to the Spanish port of Huelva.

Photo: NY Times

“The influx of LNG carriers has overwhelmed the ability of European port facilities to unload on time” said Andrew Lipow, president of Lipow Oil Associates.

According to Lipow, these delays caused natural gas inventories to increase more than the market expected.

Kpler analyst Laura Page said ships sailing from Algeria to Europe appear to have turned to Asia in search of a better price.

Massimo Di Odoardo, vice president of gas research at Wood Mackenzie, a UK-based consulting firm, said: “Europe has a stockpile that a few months ago it could only dream of. ”

Demand for natural gas has plummeted. This is also an important factor pulling the price down. The weather in autumn has started to be warmer than usual compared to every year. This means that people will not need to use much heat. However, analysts also warn that the drop in prices could be fleeting and that natural gas slated to be shipped to Europe this winter is being sold on the futures markets at significantly higher than the current price.

Don’t be happy when the price drops

European utility companies that are in the business of buying gas to generate electricity and sell to customers have suffered losses due to the Russian gas cuts and they have had to buy expensive LNG shipments in the past. Now when demand is lower than expected, they can get stuck in fuel. These facilities may have to sell cheap goods while buying expensive goods. This can cause huge financial losses.

Experts say it’s too early to feel comfortable about the prospect of cheaper gas as the market’s bearish reaction may not last. Natural gas futures prices in January and February 2023 are trading 40% higher than in November.

Prices are likely to remain volatile if Russia cuts off the remaining gas flows to Europe via Ukraine or if there are problems in energy infrastructure, such as an unexplained fault in the Nord pipeline runs from Russia to Germany.

The weather factor is also an uncertain thing. Jonathan Stern, the founder of the gas program at the Oxford Institute for Energy Studies, said: “The test will come when we have the first cold snap and storage starts to empty. We’ll see how the market reacts to that.”

According to NY Times

Source: Vietnam Insider