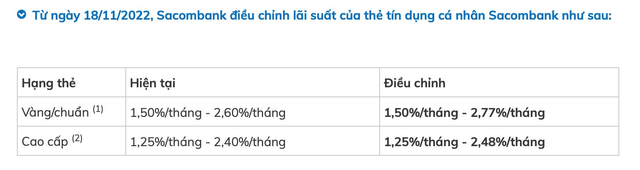

Specifically, the gold/standard credit card has an interest rate increase from 1.5-2.6%/month to 1.5-2.77%/month, which means the highest increase is 33.24%/year. because 31.2%/year as before.

In addition, premium credit cards (including Visa Infinite, World Mastercard, JCB Ultimate, Visa Signature, Visa Platinum, Visa Platinum Cashback cards) have interest rates increased from 1.25-2.4%/month to 1.25-2.48%/month, the highest is 29.76%/year instead of 28.8%/year as before.

Sacombank said that in this adjustment period, only Visa Platinum Tiki cards did not change interest rates.

Notably, besides increasing interest rates, Sacombank also increased the cash withdrawal fee of Napas domestic credit card (Family) at ATM/POS of other banks from 1% (minimum VND 10,000) to 4% (minimum 60,000 VND). This adjustment applies from November 18, 2022.

Similarly, VPBank also informed many customers about the adjustment of credit card interest rates. For example, VPBank Titanium Lady Credit credit card interest rate has increased from 2.99%/month to 3.29%/month, equivalent to an increase from 35.88%/year to 39.48%/year. This change is effective from November 23, 2022 until further notice by VPBank.

Compared to 2021, interest rates on some credit card lines at banks have also increased significantly. For example, at Techcombank, the current Infinite credit card interest rate is 19.8%/year, higher than the 15%/year rate recorded in 2021. Or Techcombank’s standard/classic cards currently have interest rates is 36%/year, an increase of about 6% compared to 1 year ago.

On 11/11/2022, Kienlongbank also informed customers about the adjustment of credit card interest rates. In which, credit card with collateral is a savings card issued by KienlongBank with an interest rate of 18%/year. Credit cards with other collateral have an interest rate of 21%/year. Unsecured credit cards have an interest rate of 28%/year. These interest rates have increased by 3-6%/year compared to 2021.

In fact, with the recent continuous increase in interest rates, the increase in lending interest rates, including interest rates on credit card products, is inevitable. Many banks have also updated the base interest rate, lending reference interest rate with a strong increase, about 0.5-1.5%/year.

With a sharp increase in the base interest rate, lending interest rates at many banks are now above 10%/year, even up to 15 – 16%/year (except for loans in priority sectors). Even with credit card products, interest rates have increased sharply to 30-40% at many banks and up to 60%/year at financial companies.

According to experts, in the current context of high interest rates, homebuyers, car buyers, and consumer borrowers need to calculate carefully and have a safe repayment plan to avoid falling into default, leading banks and financial companies to apply many strong measures to withdraw.

Currently, opening a credit card is very easy and has many conveniences, allowing users to spend first to pay later, and can also apply preferential programs, cash back,… However, , being able to spend first to pay later also causes many customers to “overstretch”, spend too much compared to income and forget to pay their debts on time. When they are overdue, they will have to pay very high interest rates and the debt will grow larger and larger, making it more difficult to pay.

Source: CafeF

Source: Vietnam Insider