VNDirect forecasts Vietnam’s economic growth in 2022 to reach 7.9%

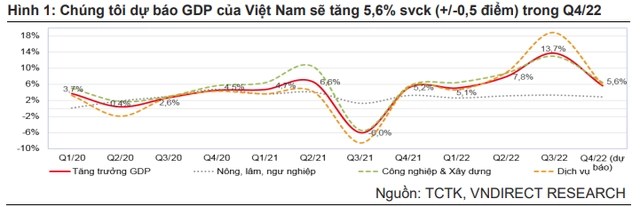

According to the latest Macro Update report of VNDirect Securities, GDP growth in the third quarter of 2022 increased by 13.7% over the same period, largely thanks to a strong increase in services (+18.7% over the same period last year), at the same time industry and construction increased well (+12.9% yoy).

In the first 9 months of 2022, Vietnam’s economy grew by 8.8% over the same period last year, VNDirect experts assessed this as the strongest 9-month growth rate in the past 12 years.

However, VNDirect’s report also forecasts that Vietnam’s growth momentum may slow down in the fourth quarter of 2022 and 2023 due to growing concerns about a global recession.

VNDirect experts point out four main risks to the Vietnamese economy in the coming time. The first is that the Fed and the European Central Bank continue to maintain tight monetary policy to control inflation, which may push interest rates higher in the future.

This has led to a decline in consumer demand, a tightening job market and slower economic growth in the US and Europe. Lower consumer demand in the US and Europe will negatively affect Vietnam’s exports to these two markets (accounting for nearly half of Vietnam’s total export value in 2021) in the coming quarters.

Second, experts believe that China’s economic slowdown will affect Vietnam’s exports to this market.

The closure of factories in China or a power cut may affect Vietnam’s manufacturing sector because many of Vietnam’s manufacturing industries are highly dependent on input materials from China such as textiles, metallurgy, … chemicals, and electronics.

Third, in terms of exchange rate, the strong increase of the USD puts great pressure on the exchange rate of Vietnam. In order to stabilize the exchange rate, the State Bank of Vietnam (SBV) had to intervene in the market and sell off a large amount of foreign exchange reserves.

However, if the USD continues to strengthen, the SBV will have less resources to intervene because foreign exchange reserves are thinner than before. In a worse case, the SBV may have to consider an increase in operating interest rates, thereby increasing business costs and negatively affecting the economic recovery.

Fourth, inflation risks still exist as the Russia-Ukraine tension risks prolonging and causing disruptions to global supply chains. Higher-than-expected inflation could hamper economic growth and lead to tighter monetary policy. The SBV has less room to maintain loose monetary policy to support the economy.

However, VNDirect’s report said that there are still a number of supporting factors to help Vietnam reduce the risk of slowing economic growth, including abundant public investment capital and the expected recovery of foreign visitors. strong next year.

Therefore, VNDirect Research forecasts GDP growth in the fourth quarter of 2022 to reach 5.6%, bringing the growth of the whole year to 7.9% over the same period last year.

In 2023, the forecasting department thinks that Vietnam’s GDP growth will slow down to 6.9% over the same period. This growth rate still puts Vietnam among the fastest growing economies in the region.

Source: CafeF

Source: Vietnam Insider