In 2022, pay more than 335 trillion VND

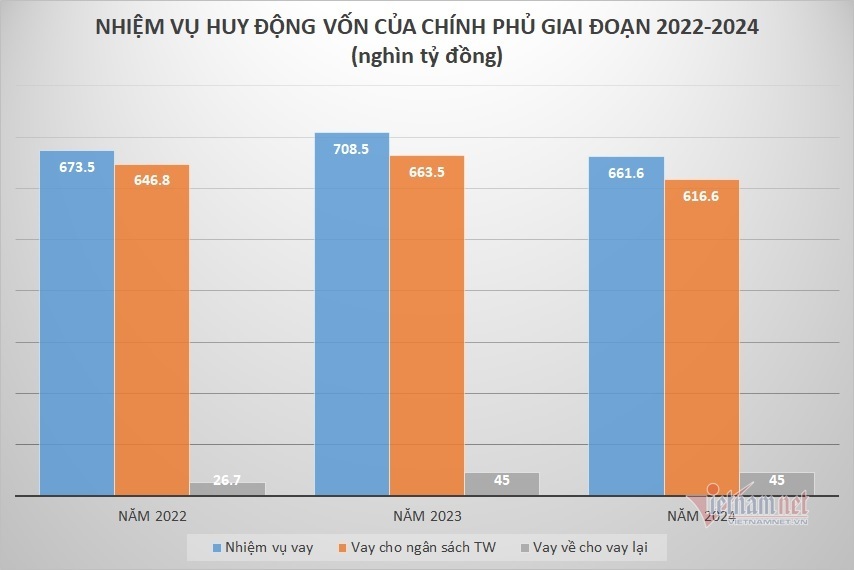

The Government’s task of mobilizing loans in 2022 is a maximum of VND 673,546 billion, including: borrowing to offset the central budget deficit of VND 450,000 billion and borrowing to repay the central budget’s principal debt of VND 196,149 billion. by the estimate approved by the National Assembly in Resolution 34/2021/QH15); mobilized ODA loans, foreign concessional loans of the Government to lend about 26,697 billion VND.

It is forecast that the Government’s debt repayment obligation in 2022 will be about VND 335,815 billion, including: The Government’s direct debt repayment obligation is about VND 299,849 billion, of which the principal repayment is about VND 196,149 billion and the interest payment is about VND 103,700 billion. . The debt repayment obligation on on-lending is about VND 35,966 billion.

On the basis of GDP revaluation, it is forecasted that by the end of 2022, public debt will be about 45-46% of GDP, government debt will be about 41-42% of GDP, and the country’s external debt will be about 40-41% of GDP. The target of direct debt repayment obligations compared to state budget revenue is expected to be about 22-23%.

“Thus, the public debt safety indicators are guaranteed to be within the debt ceiling and threshold allowed by the National Assembly”, the Ministry of Finance assessed.

It is expected that in 2022, the Government’s direct debt payment target compared to state budget revenue will be about 22-23%, within the 25% ceiling approved by the National Assembly in Resolution 23/2021/QH15.

The Ministry of Finance notes: In case the state budget revenue does not reach the expected level and the capital market fluctuates adversely, the Government must increase the interest rate on borrowing or mobilizing debt instruments with a term of less than 5 years to meet its mandate. loans for the National Financial Plan and the 5-year borrowing and repayment of public debt for the period 2021-2025 and for the program, the Government’s debt repayment obligation will be adjusted accordingly.

In the period of 2022-2024, debt repayment of more than 1 million billion VND

With a maximum increase in the state budget deficit of 240 trillion VND in 2022 and 2023, the Government’s loan mobilization task in the period 2020-2024 is about more than 2 million billion VND.

In which, borrowing to offset the central budget deficit is about 1.31 million billion VND; borrowing to repay the Government’s principal is about VND 612 trillion; loans to provincial People’s Committees, public service providers and enterprises from ODA loans and foreign preferential loans are about 117 trillion VND.

Regarding the debt repayment obligation to the Government, the Ministry of Finance said that it is expected that the total debt repayment of the Government in the period of 2022-2024 is about 1.19 million billion VND, of which direct repayment is about 1,045 million billion VND, and debt repayment. loans on on-lending is about 146 trillion dong.

In case of adverse fluctuations in the capital market, the Government must increase the interest rate on borrowing or mobilizing debt instruments with a term of less than 5 years to meet the borrowing tasks for the National Financial Plan and to borrow and repay the 5-year public debt in the next 5 years. for the 2021-2025 period and for the Program, the Government’s debt repayment obligation will be increased accordingly.

Combined with the application of tax exemption and reduction policies to implement the Program according to Resolution No. 43/2022/QH15 of the National Assembly, the Ministry of Finance noted the target of the Government’s direct debt repayment obligation compared to revenue. The budget for this period may have a year approaching 25% according to Resolution No. 23/2021/QH15 of the National Assembly. In case of big fluctuations or risks, the Ministry of Finance will report to the Government to promptly report to the National Assembly for consideration and decision.

With the plan to increase the state budget deficit by a maximum of VND 240 trillion in the two years 2022-2023 to implement the program of socio-economic recovery and development, the Ministry of Finance expects public debt to be about 46 percent by 2024. -47% of GDP, the government debt is about 44-45% of GDP; The Government’s direct debt repayment obligation compared with state budget revenue is about 24-25%.

Notably, the target of the Government’s direct debt payment obligation compared to state budget revenue in this period may exceed 25% in the year according to Resolution 23 of the National Assembly, but the Ministry of Finance said that it will strive to so that the average period of 2021-2025 is still within the limit of 25%.

In case of big fluctuations or risks, the Ministry of Finance will report to the Government to promptly report to the National Assembly for consideration and decision.

Source: Vietnamnet.vn

Source: Vietnam Insider