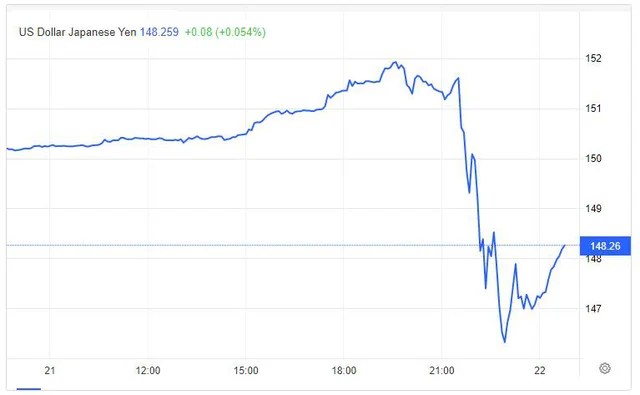

“It looks like the Finance Ministry (Japan) is intervening in the currency markets. We are seeing a lot of dollars being sold and the yen moving almost vertically,” said Karl Schamotta, chief secondary strategist Corpay’s marketing manager in Toronto said.

Mr. Corpay added: “We’ve heard there are large volumes of yen and US dollars being traded. That usually means larger institutions are transferring money or a central bank is intervening. The clearest evidence is the size of the USD selling going on.”

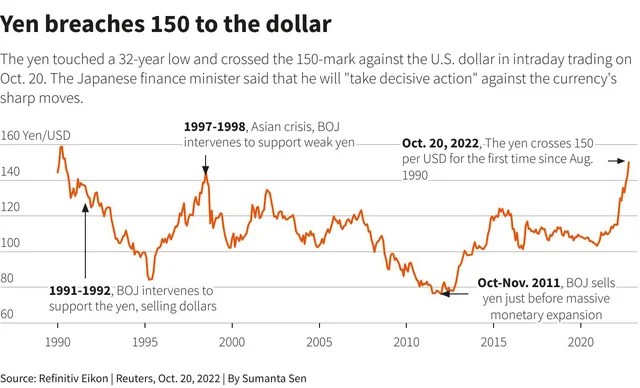

If confirmed, it would be the second time since September that Japan has intervened in the currency market to boost the yen.

The Japanese yen has fallen about 22% against the dollar this year as the Bank of Japan follows extremely loose monetary policy, while the US Federal Reserve and other major central banks actively interest rate hikes.

Japan’s Finance Ministry Shunichi Suzuki declined to comment on the matter.

A weaker yen is driving up import costs and the cost of living for Japanese households, putting pressure on Prime Minister Fumio Kishida to stem the yen’s continued decline.

The USD also fluctuated strongly against a basket of major partner currencies. At the end of October 21 in Vietnam time, the Dollar index (DXY) – which compares the USD with a basket of key partner currencies – fell 0.63% from the previous session, to 112,176 JPY/USD. Before that, during most of October 21st, DXY still gained quite strongly because USD increased against JPY for most of the week.

Despite the recent decline, the DXY at one point hit a 3-week high amid continued uncertainty about the outlook for the global economy, which has been affected by inflation. At the same time, despite the decline, DXY remains near a two-decade high.

The pound was also under pressure, falling 0.033% to $1.253 as Britain’s ruling Conservatives prepare to choose the country’s third prime minister in just two months after Liz Truss stepped down on Thursday.

Movement of the British Pound Exchange Rate.

China’s yuan on Friday fell to its lowest level against the dollar since the 2008 global financial crisis, despite efforts by major state-owned banks to stabilize the market.

According to Reuters, state-owned banks in China have also sold dollars on the domestic foreign exchange market to prevent spot prices from weakening past 7.25 CNY/USD.

State-owned banks typically trade on China’s foreign exchange market on behalf of the central bank, but they may also trade for their own purposes or execute orders for corporate clients.

The yuan on the domestic market ended the domestic session down 0.46% at 7.2494 CNY/USD, its weakest close since January 14, 2008.

For the whole week, CNY fell 0.78% as the USD continued to rise strongly, putting pressure on currencies of emerging economies, bringing the year-to-date decline to 12.3%.

Traders said yuan weakness may persist, reflecting broad strength in the dollar as Fed officials show signs of taking a step back in the inflation battle.

In the cryptocurrency market, Bitcoin also fluctuated strongly in the past session, sometimes down to $ 18,700.

Gold prices soared as investors doubted the Fed’s rate hike path.

At the end of the session on October 21, according to Vietnamese time, spot gold price increased 1% to $1,644.38 per ounce; December gold futures rose 0.7% to $1,648.70.

“A Wall Street Journal article about the pace of rate hikes is getting a lot of attention among (market) participants,” said Daniel Ghali, commodity strategist at TD Securities. The WSJ reports that Fed officials are gearing up for another rate hike, adding another 0.75 percentage point in November, while some have begun to signal a desire to slow the pace of increases soon.

References: Refinitif, Coindesk

Source: Vietnam Insider