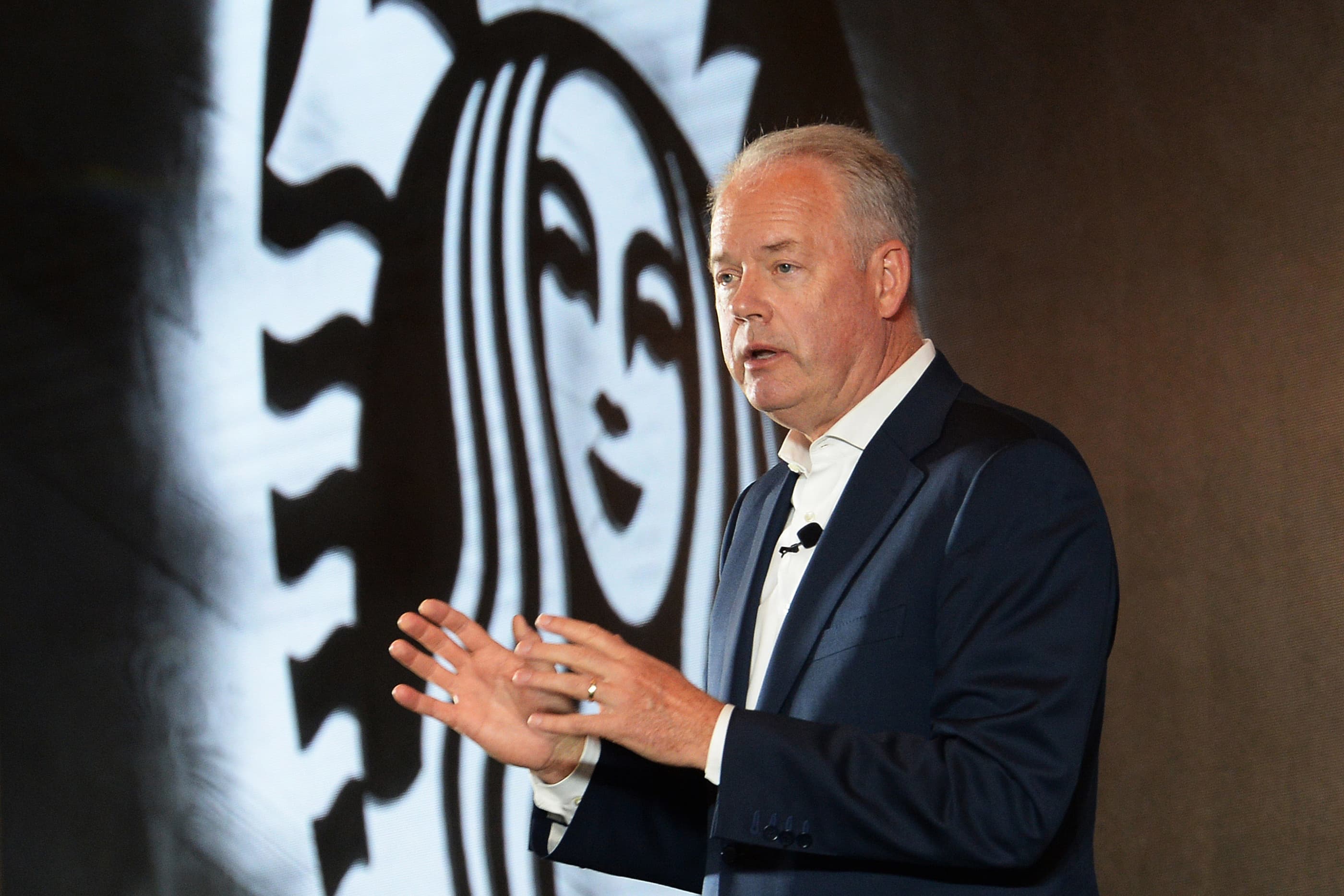

Reduced international travel and low traffic to office buildings weighed on Starbucks’ same-store sales in China, CEO Kevin Johnson said Wednesday.

“Our stores that are in airports in the international travel terminals are closed, so clearly that’s weighing on comps,” Johnson said on CNBC’s “Squawk on the Street.” “Stores that are in office districts are much slower than they used to be.”

He added that cafes in residential and commercial zones are seeing same-store sales growth, a positive sign for demand in the country. However, it isn’t enough to offset declines elsewhere. The coffee chain reported Tuesday that its same-store sales in China shrank by 14% in its fiscal first quarter. The country is Starbucks’ second-largest market, trailing only the U.S.

Starbucks stock fell as much as 3% in morning trading. In addition to same-store sales declines in its second-largest market, the coffee giant reported mixed results for its top and bottom lines and cut its earnings outlook for fiscal 2022 on Tuesday evening.

Goldman Sachs analyst Jared Garber downgraded the stock to neutral on Wednesday, citing China’s uncertain recovery and higher costs that are putting pressure on profits. He wrote in a note to clients that he has limited visibility into when China fully recovers.

To curb the spread of the pandemic, China has implemented a zero-Covid policy. When case counts tick too high in a city, the government reintroduces restrictions limiting residents’ mobility. The country reported 1,101 new cases over the last week and no deaths, according to Johns Hopkins University data.

“There’s constant waves of store closures and constraints created by that [policy],” Johnson said.

It’s unclear when China’s sales will fully bounce back. Unlike the United Kingdom and U.S., China didn’t see cases of the omicron variant until early January, and its surge is just now starting. On top of that, the Winter Olympics, which are hosted in Beijing this year, mean the country is being particularly cautious.

Source: CNBC