SoftBank posted one of its biggest losses at its Vision Fund investment unit for its fiscal first quarter, as technology stocks continue to get hammered amid rising interest rates.

The Japanese giant’s Vision Fund posted a 2.93 trillion Japanese yen ($21.68 billion) loss for the June quarter. This is the second-largest quarterly loss for the Vision Fund.

That contributed to a 3.16 trillion yen net loss for the quarter for SoftBank versus a 761.5 billion yen profit in the same period last year. That is a record quarterly loss for the company.

The company also authorized a 400 billion yen share buyback program on Monday.

SoftBank’s Vision Fund, which began in 2017 and invests in technology companies, has been hit by a slump in high-growth stocks as a result of rampant inflation that has led the U.S. Federal Reserve and other central banks to raise interest rates.

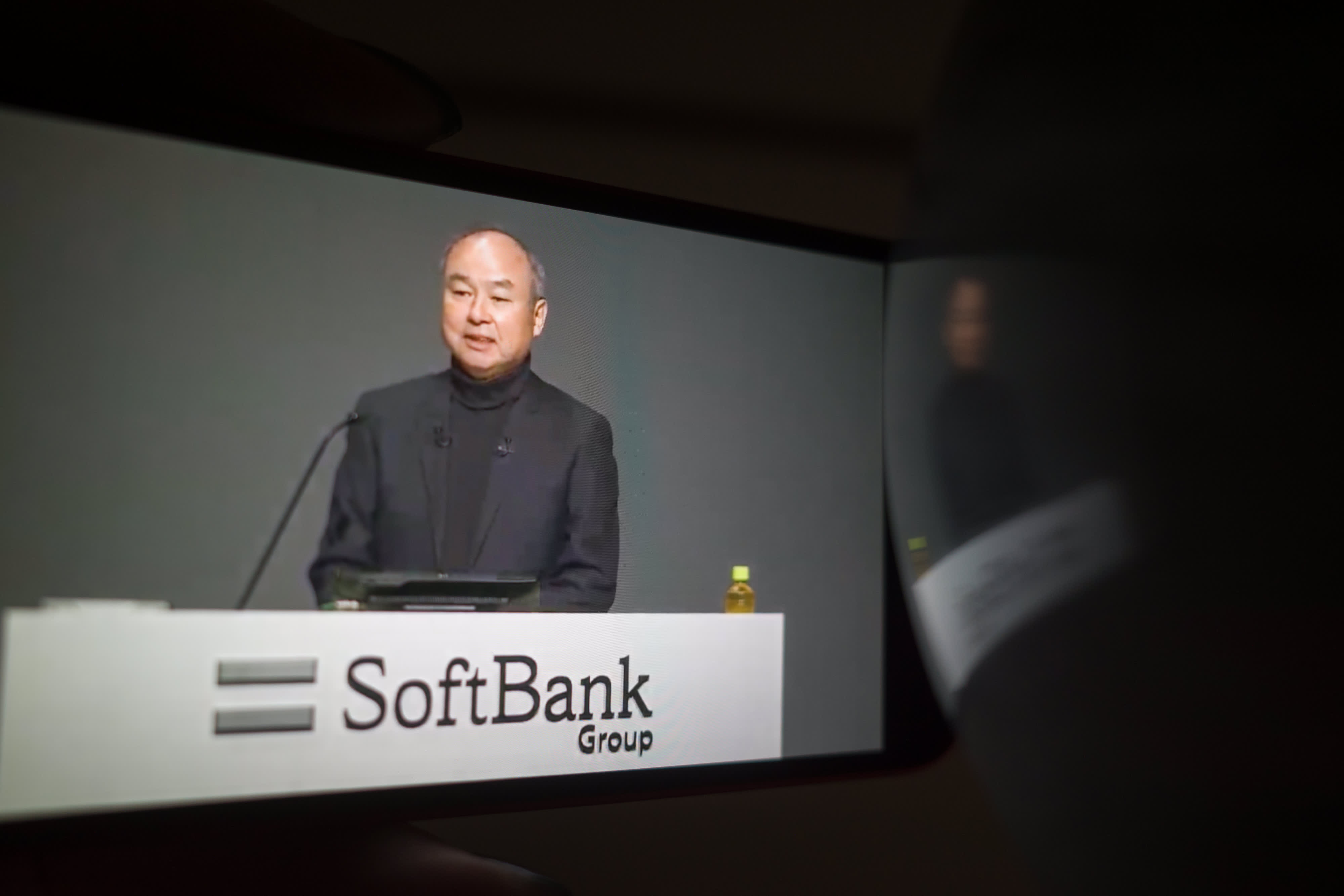

Masayoshi Son, SoftBank’s outspoken founder and the mastermind behind the Vision Fund, said in May the company would go into “defense” mode and be more “conservative” with the pace of investments after posting a record 3.5 trillion Japanese yen loss at the investment unit for the last fiscal year.

SoftBank said it saw a decline in the share prices of a wide range of its portfolio companies, which was “mainly caused by the global downward trend in share prices due to growing concerns over economic recession driven by inflation and rising interest rates.”

Shares of companies ranging from South Korean e-commerce firm Coupang to DoorDash in the United States were hit hard in the second quarter of the year.

SoftBank said the share prices of private companies in its portfolio also declined.

“The market and the world is in confusion,” Son said during a presentation on Monday. The CEO added that the company has been “more selective in making investments.”

SoftBank has relied heavily relied on public listings of its private companies in order to raise money to fund other startups. But the slump in stock markets this year has made it difficult for companies to pull off an initial public offering, particularly those in the tech sector.

The Japanese giant has turned to selling its stakes in companies to raise money. SoftBank announced on Monday that it had sold its stakes in a handful of companies, including ride-hailing firm Uber and online real estate company Opendoor. SoftBank raised $5.6 billion from these sales.

SoftBank also said that it raised $10.49 billion in the June quarter through the sale of Alibaba shares via a derivative called a forward contract. Son said SoftBank’s Alibaba holdings are a good source of cash for the company.

Son gets candid

Son said that he got overexcited during the period last year when technology stocks were booming but now feels “embarrassed” by that reaction.

With the first Vision Fund, Son said SoftBank was “making big swings and couldn’t hit the ball.”

He said his “emotion was very strong toward specific companies” but he has since learned his lesson.

With the second Vision Fund, which was founded in 2019, the company “became more systematic” and invested smaller amounts per round of funding in companies in order to improve profitability.

“Rather than aiming for the home run … (we) try to aim for the first base or second base hit,” Son said.

However, given the troubles at SoftBank’s investment unit, Son said that the headcount at the Vision Fund may need to be “reduced dramatically.” The CEO said that “cost reduction” will need to be done at the SoftBank group level too across different units.

Son continues to lose key allies, however. Rajeev Misra, who effectively ran the Vision Fund, will be stepping back from some of his responsibilities at Vision Fund 2.

Misra is a “key man,” according to Son, and will still support SoftBank’s investing efforts.

Source: CNBC