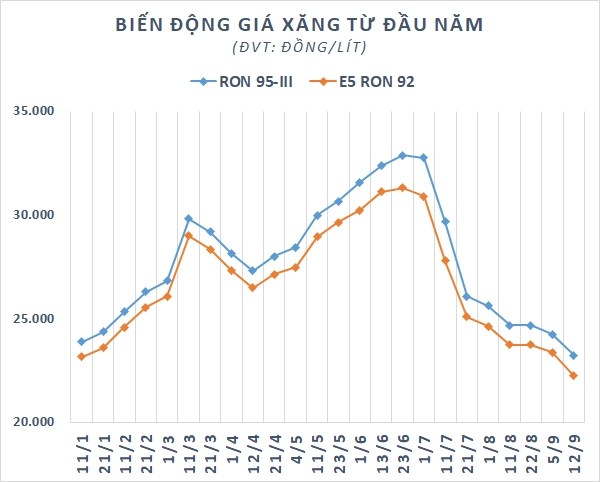

In the same direction as the downtrend of petrol prices, the stocks of the two largest petrol retailers in the country, Petrolimex (code PLX) and PV Oil (ticker symbol OIL) also drifted to the bottom despite the general market’s recent downturn. recovery rate is quite positive.

At the end of the September 12 session, PLX stopped at 40,250 dong/share, down nearly 37% compared to the highest price achieved since the beginning of the year. The current market price of this stock is only slightly higher than the 2-year bottom confirmed in mid-May. Meanwhile, OIL is also very close to the one-year bottom with a market price of 12,700 dong/share. , nearly 41% lower than the peak reached in early March this year.

Petrolimex’s market capitalization has been blown by nearly 28,400 billion dong (~1.2 billion USD) from its peak at the end of February to 49,330 billion dong. Similarly, the capitalization of PV Oil has also decreased by more than 9,400 billion dong after more than 6 months, to 13,800 billion dong.

It is estimated that there are more than 15,000 petrol and oil retail stores nationwide, providing tens of millions of tons of products to consumers every year. However, the majority of Vietnam’s petroleum market is still in the hands of state-owned enterprises, of which the two “big guys” Petrolimex and PV Oil hold up to 70% of the market share. Therefore, the decrease in gasoline prices will significantly affect the revenue of these two businesses.

Previously, both Petrolimex and PV Oil set a record of revenue in the second quarter, respectively VND 84,400 billion and VND 30,400 billion, up 81% and 130% respectively over the same period. In just 3 months of the second quarter, the total revenue of the two largest petroleum retailers in the market was approximately VND 115,000 billion, equivalent to about VND 1,250 billion per day.

However, with the recent sharp drop in gasoline prices, it is hard to expect that the revenue of these two businesses will continue to break records in the third quarter. Even, sales of Petrolimex and PV Oil may increase. negative major. If this happens, it will put great pressure on the profit of these two petrol retailers, not to mention the need to make provision for large inventories.

According to statistics, the inventories of these two enterprises have increased sharply since the beginning of 2022, even at one time, Petrolimex’s own inventory exceeded 1 billion USD at the end of the first quarter. Although it decreased by nearly 3,000 billion VND in the quarter. 2, but the inventory of this enterprise is still very high at more than 21,500 billion dong, including provisioning of more than 1,330 billion dong. For PV Oil, the inventory continued to increase in the second quarter to 5,335 billion dong, however, this company only made provision for more than 1 billion dong as of June 30.

With both world oil prices and domestic gasoline prices falling sharply since the beginning of the third quarter, it is likely that these two enterprises will have to increase their provisioning for the coming reporting period. This will likely “eat away” the profits of both Petrolimex and PV Oil.

Before that, Petrolimex suddenly suffered a “technical” loss of 141 billion dong in the second quarter. According to the company’s explanation, the cause of the loss was due to making provision for devaluation of inventories as at 30. June 2022 based on net realizable value at the time of preparation of financial statements (July 20, 2022).

Because the domestic gasoline price fluctuates in a downward direction (over 3,000 VND/liter), it leads to an additional provision of VND 1,104 billion instead of a reversal of nearly VND 156 billion if based on the net realizable value. obtained at the cut-off date of June 30, 2022. Accordingly, the cost of goods sold in the period increased and profit before tax decreased by more than 1,259 billion dong, respectively.

In contrast, PV Oil recorded a record profit of nearly 510 billion dong in the second quarter, an increase of 87.5% over the same period in which the profit after tax for shareholders of the parent company reached 403 billion dong. However, it should be noted that at the end of the second quarter, domestic gasoline prices were at the peak of many years and PV Oil had only made a very small provision.

It can be seen that the recent drop in domestic gasoline prices was partly reflected in Petrolimex’s profit last quarter while PV Oil still fully benefited from the high selling price in the second quarter. However, The “gray streaks” are likely to appear more on the profit picture of both these two petroleum retail “giants” in the next 3rd quarter.

Source: CafeF

Source: Vietnam Insider