In the ever-evolving landscape of banking, MSB has demonstrated its resilience and prowess by securing a place among the top contenders in the realm of Current Account and Savings Account (CASA) ratios.

As of the end of the second quarter in 2023, MSB’s CASA ratio stood at an impressive 24.2%. This figure, though slightly reduced from the beginning of the year, is a testament to MSB’s commitment to maintaining a strong foothold in the CASA market. Notably, there was a period when MSB even outperformed the industry giant Vietcombank, briefly claiming the third spot in CASA ratios.

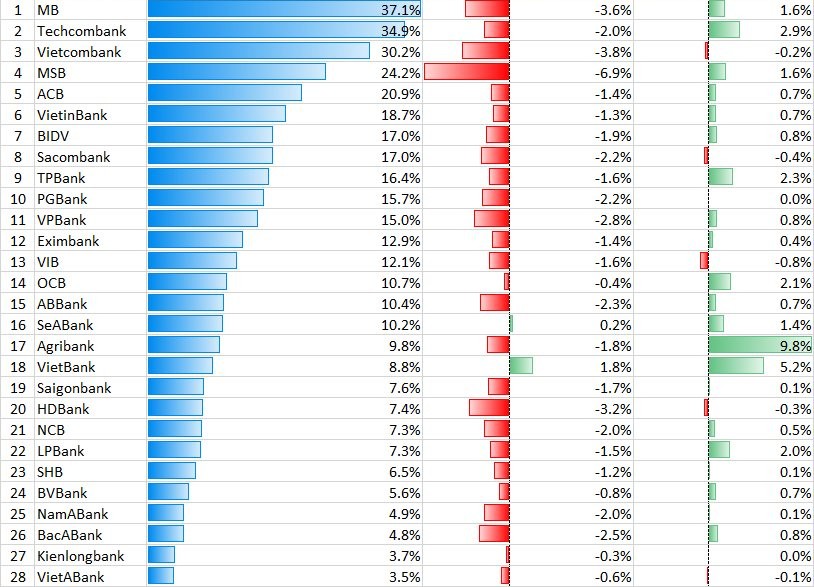

The recently unveiled financial report for the first half of the year sheds light on a noteworthy trend across various banks. While many financial institutions faced a significant decline in their non-term deposit ratios (CASA) during the first quarter of 2023, the subsequent quarter marked a gradual recovery. However, the second quarter’s recovery was not entirely sufficient to counterbalance the negative trajectory experienced in the first quarter. Consequently, as of June 30, 2023, CASA ratios across most banks remained below their initial levels at the beginning of the year.

As of June 30, 2023, the top 10 banks with the highest CASA ratios were ranked as follows: MB, Techcombank, Vietcombank, MSB, ACB, VietinBank, BIDV, Sacombank, TPBank, and PGBank.

A prevailing trend reveals substantial diversification in CASA ratios among different banks. Smaller banks like VietABank, Kienlongbank, BacABank, and NamABank all recorded CASA ratios below 5%. Meanwhile, major private banks such as SHB and LPBank retained a significant proportion of term deposits, with CASA ratios hovering around 7%.

The significance of a high CASA ratio lies in its ability to dilute the costs associated with capital acquisition, ultimately bolstering profit margins. This metric reflects a robust foundation for advancing payment services and digital banking. Additionally, it underscores the potential for cross-selling various products and services.

It is evident that banks heavily invested in digital transformation have gained an advantage in the CASA race. The proliferation of convenient and cost-effective services is driving customers to adopt these institutions as their primary banks, leading to more frequent transactional activities.

Leadership within MSB shared insights into the recent surge in demand for CASA accounts. The growing prominence of electronic banking services, particularly cashless payment options, has driven a surge in CASA account openings. Customers now utilize these accounts not only for essential utilities such as electricity, water, internet, and television but also for purchases ranging from small, everyday items to luxury goods. Consequently, the balances within CASA accounts have seen a substantial uptick.

Banks that can uphold a stable and commanding CASA ratio will be well-positioned to navigate market challenges and uncertainties. A higher CASA ratio equates to lower capital costs for the bank, providing a competitive edge against rivals.

However, the endeavor to boost CASA ratios has encountered difficulties, especially due to the surge in deposit interest rates since late 2022. This phenomenon has exerted substantial pressure on banks’ profit margins, as evidenced by the notably slower growth in profits during the first half of the current year compared to previous years. As a result, these institutions are actively implementing strategies to rekindle the inflow of cost-effective capital.

Related

Source: Vietnam Insider