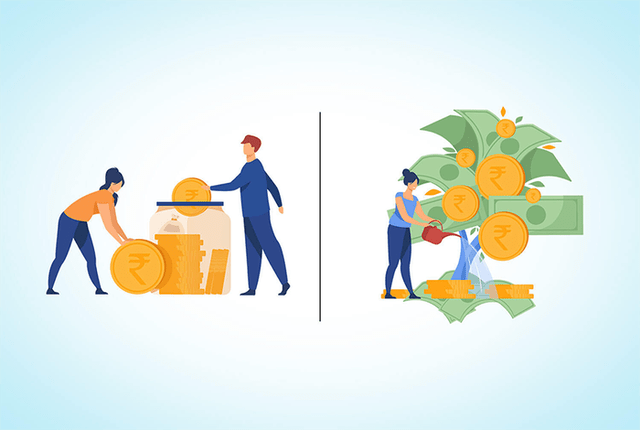

Savings and investments should be separate

In some financial conversations, the two words “saving” and “investing” are sometimes used interchangeably. A common feature of savings and investments is their primary importance in life. In fact, they are completely different things, serving different purposes and playing different roles in financial strategy.

Saving is the process of storing money for future expenses or needs by depositing money in a bank. Savings are short-term and used for emergencies and purchases, which can be spent without much research.

Meanwhile, money investing is the process of using money to buy assets that have value over time and provide high returns, but you also need to accept a lot of risks. Investments are made to achieve larger goals such as building a property, buying a home, etc. They often require long-term commitments and market research.

Financial experts say that you should have at least a savings account in the bank that is enough to cover all expenses within 3-6 months. If your savings exceed this limit, you should consider switching to investments.

Invest to achieve long-term goals

There are two ways to make money in our modern world. The first way is to earn an income, by working for yourself or others. The second way is to invest assets so that they increase in value over time. You can invest in stocks or bonds, real estate, businesses… with the goal of making money.

Especially if you want to build wealth, investing will help you get there with an investment plan that is right for you and your goals. When you are financially stable, you can pursue the lifestyle you desire.

Besides, the wealth you pass on to the next generation can have a profound impact on your heirs. For example, providing educational opportunities, capital to start a business, or financial support for children…

At the same time, you can use your wealth to impact the world in a meaningful way, like creating positive change in your community.

Manage your finances as soon as possible

Maybe the amount of money used to invest is not large, early investment can effectively generate larger profits, in the long run, will have significant results. The sooner you learn how to manage your money, the higher your chances of financial success.

When you have a solid understanding of personal finance and money management skills, you have more confidence in the face of financial challenges. In addition, having a clear income and expenditure plan helps you determine the appropriate and necessary spending, save money for the future, and invest properly. Financial management helps to know which expenses need to be handled first and which ones later. You will pay your bills, save and invest every month efficiently.

Send savings or invest automatically

Many people already know that one of the basic principles of personal finance is “pay yourself first”. However, debts or monthly bills have “swallowed” all the money as soon as they receive their salary.

With automatic savings or investment plans, you really put “paying yourself first” first. As soon as you receive your salary, you automatically transfer a certain amount to a savings or investment account every month. This is to avoid the “temptations” of unnecessary spending and purchases.

After making this automatic transaction, you can use the remaining money to pay your bills and spend on demand. As billionaire Warren Buffett once said, “Don’t save what is left after you spend, spend what is left after you save”.

According to Aboluowang

Source: Vietnam Insider