According to estimates from price tracking website CoinMarketCap, a massive sell-off has wiped more than $200 billion off the market in just 24 hours.

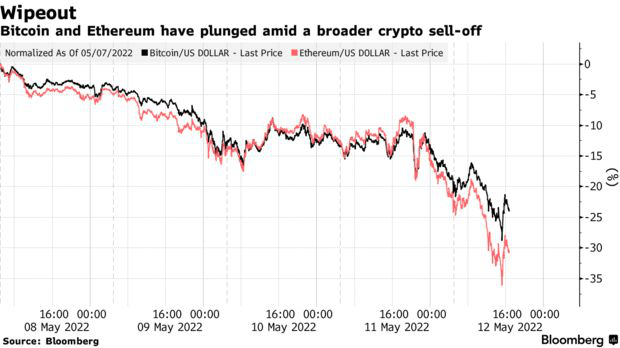

This large-scale plunge is partly due to the collapse of stablecoin TerraUSD, which has hit major tokens hard. Bitcoin has dropped as much as 10% in the past day to its lowest level since December 2020, while Ethereum price is down as much as 16%.

The fall showed signs of spreading further on Thursday as crypto-related stocks in Asia also fell. A Hong Kong-listed fintech company called BC Technology Group Ltd. Closing the session saw the stock drop 6.7%. Shares of Japan’s Monex group, which owns TradeStation and Coincheck, ended the day down 10%.

As central banks around the world tighten monetary policy to combat inflation, digital tokens have faced selling pressure amid growing risks.

However, crypto investors are no stranger to wild swings in the market. As a result, Bitcoin and Ethereum narrowed their losses and ended the session down 4.2% and 9% respectively at 4:45 pm Hong Kong time.

According to CNBC, research figures show that 40% of Bitcoin players are “underwater”, meaning the value of the digital currency they hold is less than the amount they originally spent.

Specifically, a report by data analysis firm Glassnote shows that Bitcoin has lost 55% of its value since its November 2021 peak, and that the percentage of Bitcoin players “underwater” is even greater if investors are included. Short-term speculation in the past 6 months when buying at $69,000.

In addition, Glassnote’s report also shows that 15.5% of Bitcoin wallets globally in the past month have fallen into an unrealized loss (Unrealized Loss) when this digital currency is down. level of 30,000 USD.

Glassnote’s report also pointed out that “from whale to fish” of the cryptocurrency market almost all have reversed views on the cryptocurrency market. E-wallets with more than 10,000 Bitcoins have been the main sellers in the past few weeks, while retail speculators clamoring to buy (mostly wallets with less than 1 Bitcoin) are falling less and less than February-March 2022.

In the same opinion, Fundstrat Global Advisors has predicted that Bitcoin may drop to $ 29,000 and recommends that investors take hedging measures in the next 1-3 months.

“Disaster” TerraUSD

Recently, the algorithm-controlled stablecoin TerraUSD (UST) has lost a disaster as investors sold off and waited for rescue moves from founder Do Kwon. Before the crash, the total capitalization of UST was about 18.4 billion USD, today it is only about 7.5 billion USD.

Similarly, the Luna coin has depreciated from a peak of $120 to around $0.002 in just one month. The total capitalization of this coin has gone from $36 billion to just over $85 million, down 94%.

Usually, stablecoins are digital currencies that are pegged to a stable asset like gold or fiat money (USD, EUR…). On the market today, there are a number of coins such as USDT or USDC that are pegged to the USD.

However, UST is a digital currency that has the ambition to remove this stable collateral in order to completely abandon the involvement of banks, thereby becoming the standard for exchange rates for digital currencies.

Specifically, Terra’s platform allows UST and Luna to be converted to each other at a fixed exchange rate. That is, no matter how much 1 UST is in the market, you can still exchange 1 USD worth of Luna and vice versa. Thanks to this mechanism, investors can speculate on arbitrage as well as maintain the theoretical nominal standard price.

As advertised, the UST coin will anchor the nominal exchange rate of 1 UST to 1 USD thanks to the money burning mechanism. That is, to exchange for Luna, the Terra platform will burn the corresponding amount of UST and vice versa, thereby self-regulating supply and demand.

In addition, keeping the nominal exchange rate on the Terra platform also stimulates speculators to trade to eat the difference, thereby helping to balance the market to bring the real exchange rate back to the nominal standard.

However, anchoring 1 digital currency to another digital currency and vice versa and then using an algorithmic mechanism to burn less coins when converting is also risky. That’s when both currencies depreciate because speculators lose faith in both, then there will be no market equilibrium trade because everyone wants to sell and take profits.

Source: CafeF

Source: Vietnam Insider