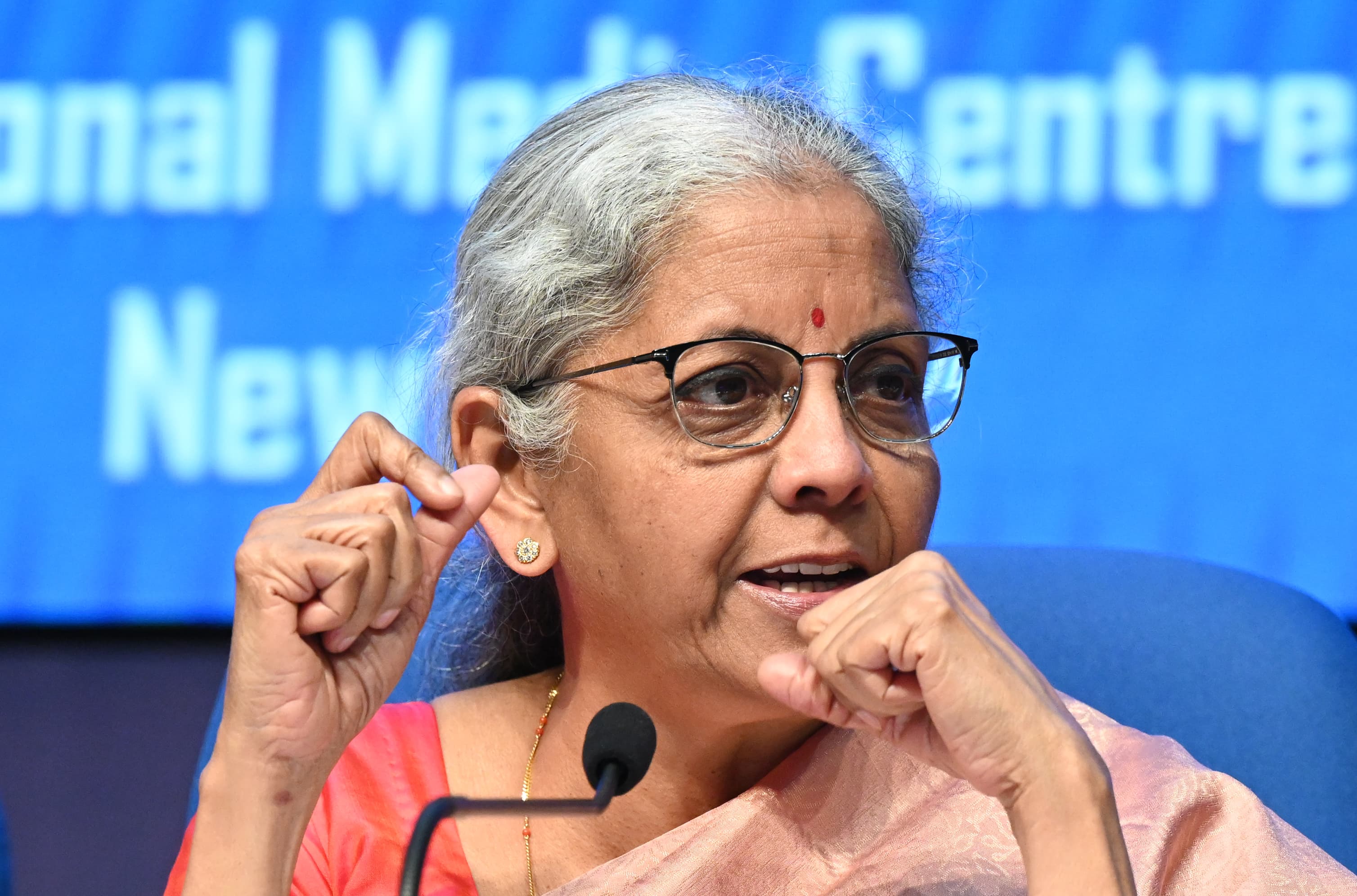

India’s Finance Minister Nirmala Sitharaman said Friday the country’s exports remained strong despite slowing global demand, explaining that these economic issues will be a key focus ahead of the upcoming General Election.

Sitharaman told CNBC’s Sri Jegarajah in an exclusive interview that “despite the challenges of slowing demand elsewhere, particularly in Europe, our exports have grown and are consistently are remaining in a growing path.”

She noted that exports from India were branching out into newer areas of trade such as Latin America, namely Brazil and parts of Africa.

“Newer areas of innovation and new areas of manufacturing have created a buzz about India’s capacities … So a lot of new people are accessing India,” Sitharaman said, while touting that India was able to showcase its digital public infrastructure at the G20 summit it hosted in New Delhi last year.

India’s exports were previously expected to touch $900 billion in the current financial year, a rise from $770 billion in the previous year — a rare bright spot among G20 nations. However, reports suggest that recent tensions in the Red Sea could shave $30 billion off that figure. No official figures are currently available.

The focus will now shift toward India’s General Election in the next quarter, where Prime Minister Narendra Modi’s government, riding high in the polls, will try to hold on to power for an unprecedented third straight term.

Sitharaman, when asked about what economic issues will define the vote, said “if economic issues are to dominate the election, it would be the recipients of the beneficiaries themselves coming out to say, ‘I’m empowered now’.”

“If anything, for us it will be performance on the economic issues, good performance, inclusive growth that we’ve offered.”

Fiscally prudent budget

Sitharaman delivered the government’s interim budget Thursday, saying the fiscal deficit for the financial year 2025 will narrow to 5.1% from the revised 5.8% for 2024, while emphasizing the government’s plan to boost spending on infrastructure.

The interim budget estimated that capital expenditure will rise by 11.1% to 11.11 trillion Indian rupees ($133.9 billion) in the fiscal year 2025, while tax revenue for the year is expected to rise by 11.4% to 38.31 trillion rupees.

India’s fiscal year starts on Apr. 1 and ends on Mar. 31.

“We have managed with a sense of prudence, where wasteful expenditure could be avoided, where optimal utilization of money could be done for per rupee spent, I need to get enough bang for the buck,” Sitharaman told CNBC.

The interim budget is typically a stop-gap financial plan during an election year, aimed at meeting immediate financial needs before a new government is formed. The full budget will only be released after the elections.

Sitharaman noted newer areas of spending by the government including energy, renewable energy, semiconductors, minerals among others.

“The government delivered on the need of the day, which was to responsibly bring down the fiscal deficit at a time when state fiscal deficits are rising, such that, over time, India leaves enough resources to fund private sector capex,” HSBC’s chief economist for India and Indonesia, Pranjul Bhandari said in a note.

Bhandari said the fiscal math looked realistic and that India managed to deliver a “no-compromise” budget.

Road to a $5 trillion economy

India’s Finance Ministry said earlier in the week that the country could become the world’s third-largest economy by 2027 with a gross domestic product of $5 trillion.

The country’s chief economic advisor, V. Anantha Nageswaran, said India is poised to grow at or above 7% in the fiscal year 2024, noting the government’s goal is to become a developed country by 2047.

Nageswaran told CNBC’s “Street Signs Asia” on Friday that the broader parameters of the full union budget will likely remain unchanged from the interim budget, which can be considered a “skeletal outline” of what is to come.

Nageswaran was confident that India will most likely meet its fiscal deficit target but warned that higher oil prices could pose as a risk for the oil importing nation. “But on the contrary, I would say the preponderance of probability with respect to the growth target and the deficit target for FY25, is that we have built in enough buffers in our estimation, that we will be able to meet those.”

— CNBC’s Naman Tandon and Charmaine Jacob contributed to this story.

Source: CNBC