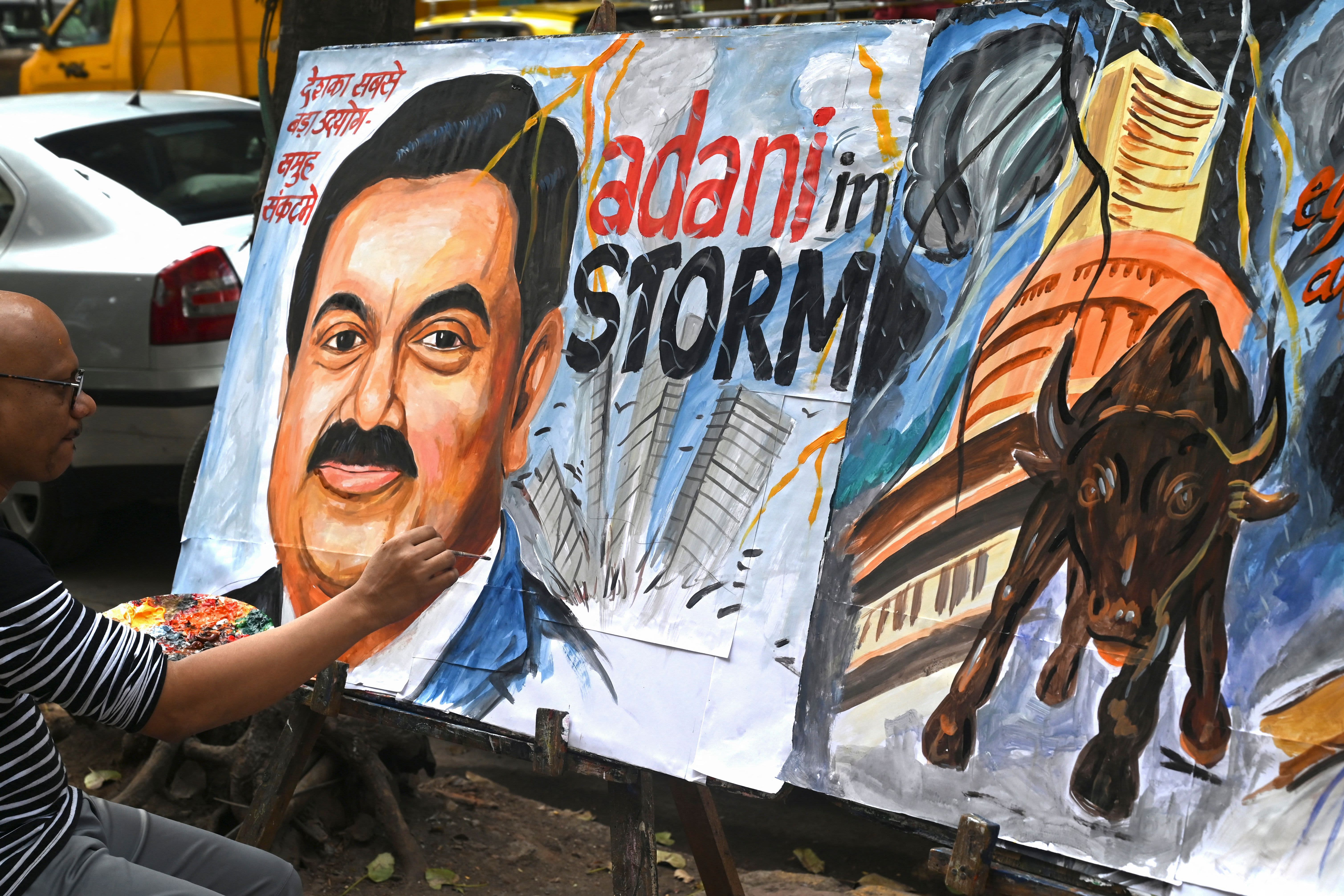

Indian billionaire Gautam Adani has downplayed the recent market volatility of Adani Group’s shares as “temporary.”

His comments came Tuesday in the quarterly earnings release of Adani Enterprises, the flagship business of his conglomerate which spans ports, energy and media.

The tycoon said the conglomerate’s success was a result of its “strong governance” and “strict regulatory compliance.”

“The current market volatility is temporary,” Adani said. He added the conglomerate “will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow.”

Shares of various Adani Group companies saw a massive sell-off after U.S. short-seller Hindenburg Research accused it of “brazen stock manipulation” and “accounting fraud.”

The Adani Group has denied those accusations, and said it was a “calculated attack on India.”

Adani flagship earnings

On Tuesday, Adani Enterprises reported a profit after tax of nearly $100 million for the October to December quarter. This was against a loss of $1.5 million in the same period a year ago.

Total revenue grew 42% to $3.3 billion year-on-year, on the back of stellar performance in its airports, coal trading and new energy businesses.

Nobody wants to see Adani [Group] suddenly collapse because these infrastructure projects are big. The assets are good. They serve a mission critical purpose…Anand Batepatiportfolio manager, GFM Focus Investing

“Over the past three decades, as well as quarter after quarter and year after year, Adani Enterprises has not only validated its standing as India’s most successful infrastructure incubator, but has also demonstrated a track record of building core infrastructure business,” said Adani in the results statement.

Shares of Adani Enterprises last traded about 3% higher Wednesday on National Stock Exchange of India.

Despite the crisis, the Adani conglomerate is critical to India’s growth story, said Anand Batepati, portfolio manager at GFM Focus Investing.

“Nobody wants to see Adani [Group] suddenly collapse because these infrastructure projects are big. The assets are good. They serve a mission critical purpose and they’re aligned to all these development goals the government is shooting for,” Batepati told CNBC’s “Streets Signs” on Wednesday.

“So, I don’t think the access to [Indian] capital markets, whether it’s the banks or the rupee bond market, is going to be closed to Adani,” added Batepati. “It is possible though that there’s going to be more scrutiny.”

Not a ‘Lehman moment’

The Securities and Exchange Board of India is expected to meet Finance Minister Nirmala Sitharaman on Wednesday, to give an update on its investigations into the Adani Group, Reuters reported, citing sources.

India’s central bank, the Reserve Bank of India, has also said “the banking sector remains resilient and stable,” citing its own assessment of the situation. The RBI said it will continue to monitor the stability of the industry.

Batepati said the Adani crisis is unlikely to have the same fallout as the collapse of U.S. investment bank Lehman Brothers in 2008, which triggered a string of big Wall Street bailouts and a subsequent financial crisis.

“The Reserve Bank of India recently asked everybody to furnish their exposure to the Adani Group in light of the recent developments. It was a pretty small number… that reported back,” said Batepati.

While he acknowledged the true extent of the exposure to the Adani Group could be possibly bigger, at least, “at face value, these numbers are quite small and it’s not like you’re going have a Lehman moment because of Adani.”

Source: CNBC