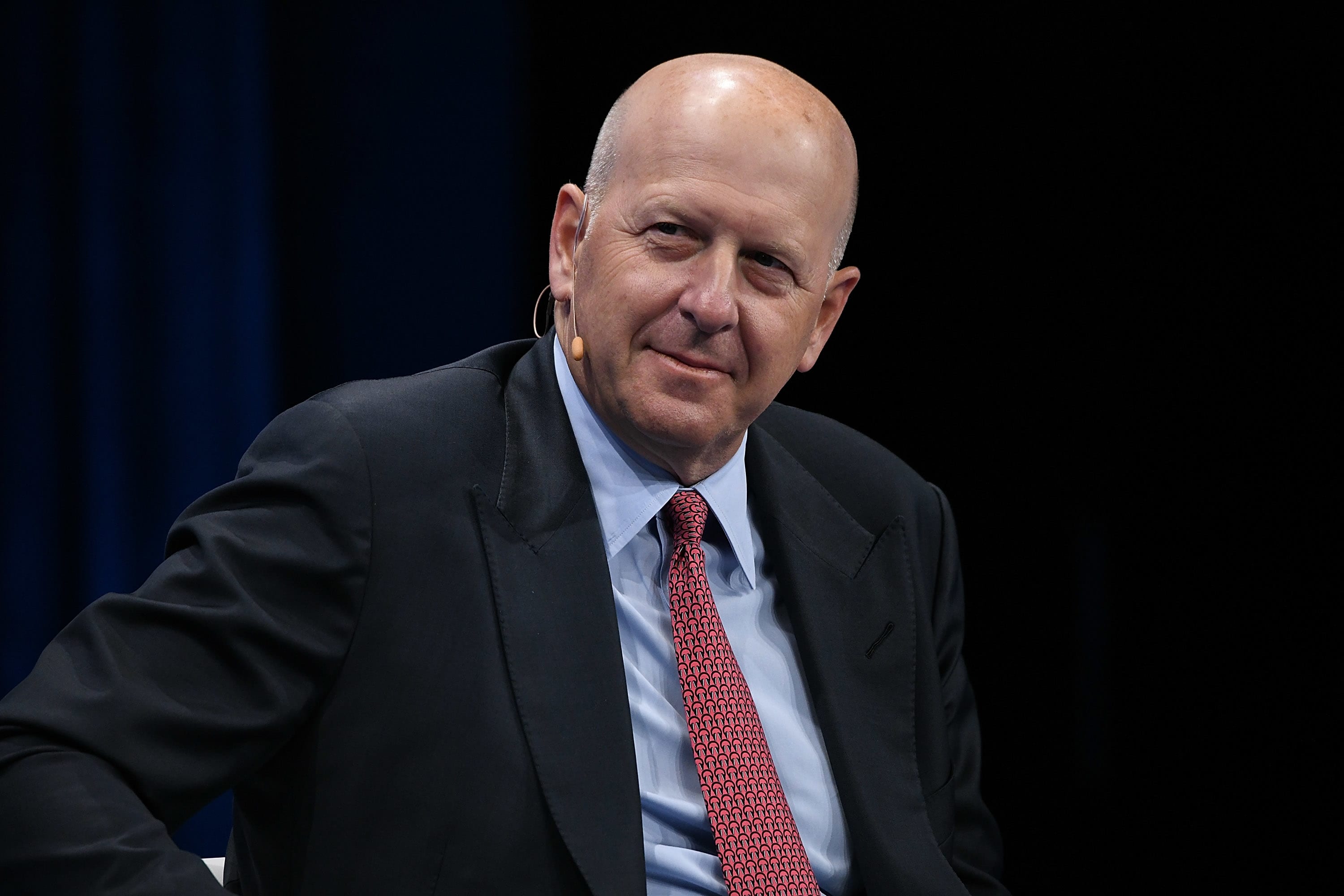

India has a “very, very high growth trajectory,” but bureaucratic challenges persist, CEO of Goldman Sachs David Solomon said in an exclusive interview with the Economic Times.

Economists at the investment bank expect India’s economy to grow by 6% to 7% over the next three years, Solomon said.

“It’s especially exciting as businesses around the world continue to diversify supply chains and think differently about where there is growth and where they can do business,” he told the Indian news publication. “It’s a fascinating time to really take stock of what’s going on here.”

There’s a great opportunity here because of the population size and growth, but there are challenges in terms of how certain parts of bureaucratic structure work…David SolomonCEO of Goldman Sachs

The CEO spoke about deglobalization and what it means amid “U.S.-China decoupling,” a term that refers to the dismantling of economic reliance between the two rivals.

“A great deal has happened in the world and I think looking at India, people see opportunity. They see it with a slightly different lens than they did back in 2019,” he said.

U.S.-China rivalry

To be clear, he does not think the U.S. and China are decoupling.

He said there will be changes to the terms of engagement going forward, “but that is different from a complete economic decoupling. In turn, it presents a very interesting opportunity for India, but it’s also not without challenges.”

Still, he said that investing in the country comes with its own set of challenges.

Global CEOs he spoken to think of India as “a big growth opportunity while also recognising some of the challenges of investing here.”

“There’s a great opportunity here because of the population size and growth, but there are challenges in terms of how certain parts of bureaucratic structure work and those are things I know CEOs always think about and focus on when diversifying their supply chains,” Solomon said.

Read more about why Goldman Sachs is bullish on India in the Economic Times.

Source: CNBC