The biggest Wall Street equity rout since the 1987 crash has sent risk-assets tumbling in Asia and havens into a spin.

Investors are spooked that emergency fiscal and monetary packages won’t be enough to stave off a recession as the impact of the deadly coronavirus continues to mount.

Here’s a look at key moves in different asset classes:

Stocks

Fears of the economic impact of measures to contain the coronavirus have sent the major Asian equity markets deeper into bear market territory and key technical levels are being breached. The MSCI Asia Pacific Index fell as much as 6.7% Friday, breaking an 11-year uptrend amid the global stock rout.

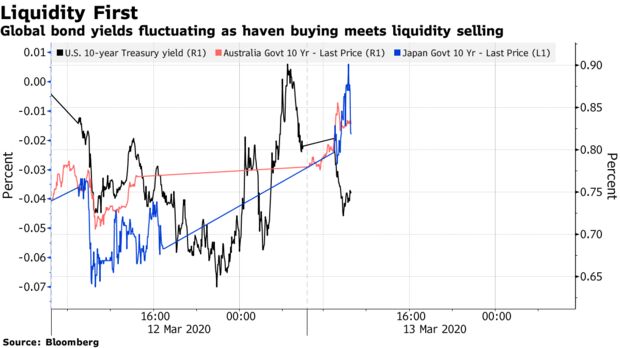

Bonds

Whereas previous periods of risk-asset weakness sent investors rushing to government bond havens, this time a demand for cash has also sparked a flood of sell orders. The result is bond yields climbing in Japan and Australia Friday as their Treasury counterparts fluctuated.

Currencies

The yen put in a mixed performance Friday, slipping against a resurgent dollar while pushing higher against other global peers. Muddying the picture for the haven currency was investors selling safer assets to raise cash as well as reports that the Bank of Japan will likely expand its stimulus measures at its meeting next week as it seeks to limit the blow from the coronavirus outbreak and reassure volatile markets.

Flows

Foreign stock investors have been pulling money out of Asia since February, pushing year-to-date equity outflows from Asia’s major markets excluding China to about $24 billion. That has wiped out all the inflows the region attracted in 2019, according to data compiled by Bloomberg.

Credit

Borrowing costs in Asia’s dollar bond market have surged, as has the price of insuring such debt against default, following similar moves in the U.S. and other regions. The spread on the Bloomberg Barclays Asia Dollar Investment-Grade Bond Index has hit its highest since 2016.

Volatility

Volatility has exploded as stocks plunged and credit-markets buckled. Front-month futures on the Cboe Volatility Index have soared to over 60 points, the highest since the financial crisis, making the 2018 Volmageddon spike look just a blip.

Virus Update

For investors keeping tabs on moves in global markets since the virus first came to traders attention, stocks have been the most affected, falling well into a bear market. The MSCI AC World Index is down over 26%, while a Bloomberg Barclays gauge of global bonds is up over 5%, since the close of trading on Jan. 20, just before concerns about the illness first sparked a major equity sell-off.

Virus Hit

Sell-off from coronavirus fears has hit stocks the worst and boosted bonds

Source: Bloomberg Barclays, MSCI indexes — With assistance by Finbarr Flynn