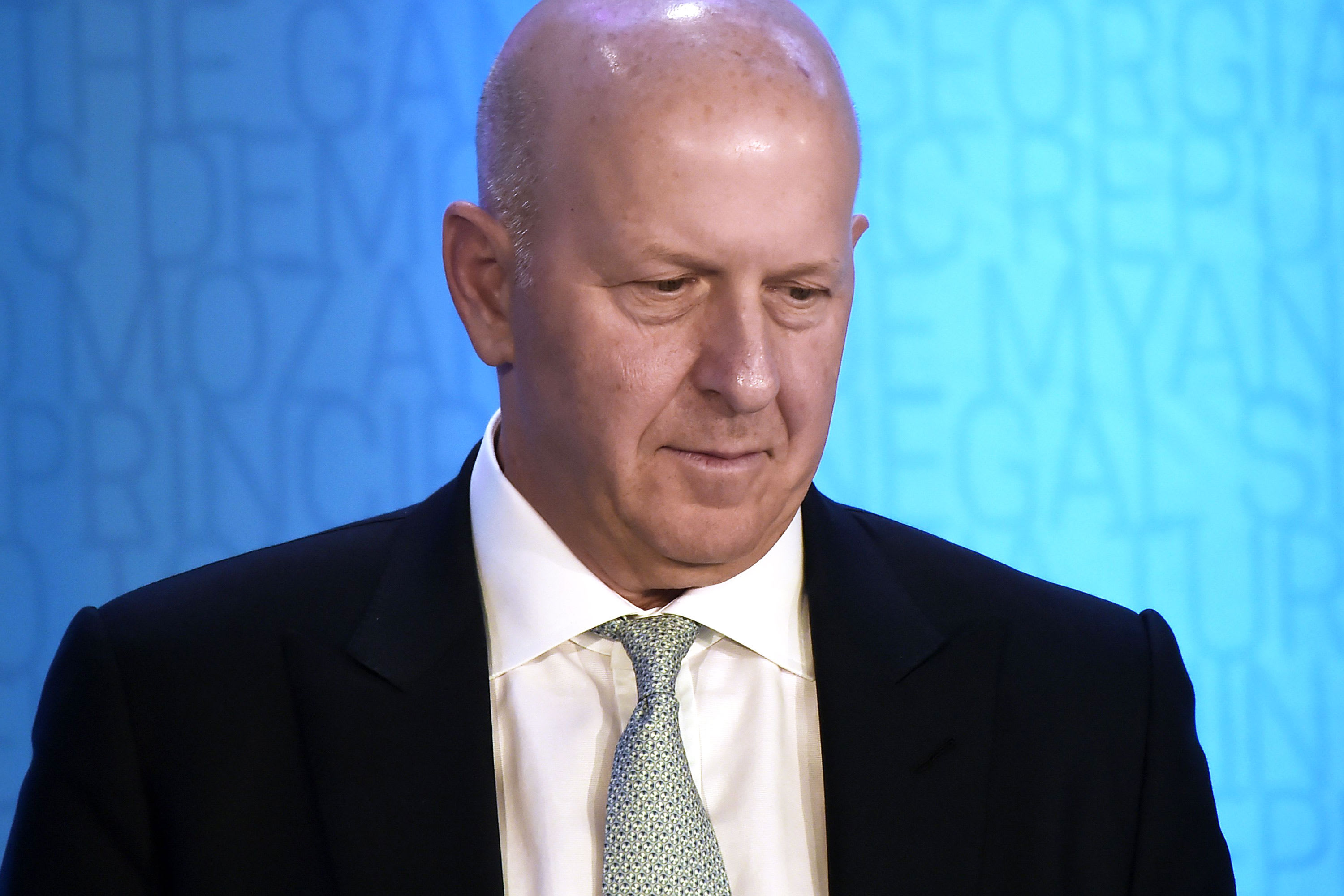

Goldman Sachs CEO David Michael Solomon attends a discussion on “Women Entrepreneurs Through Finance and Markets” at the World Bank on October 18, 2019 in Washington, DC.

Olivier Douliery | AFP | Getty Images

Goldman Sachs agreed to pay more than $2.9 billion to regulators around the world, including a record penalty for violating a U.S. anti-corruption law, to resolve probes into its role in an international finance scandal.

That sum includes about $600 million in fee disgorgement that was included in an earlier settlement with the government of Malaysia. The $2.9 billion also includes individual deals with regulators in the U.S., the U.K., Singapore and elsewhere, according to a release Thursday from the the U.S. Department of Justice.

The bank’s parent company entered a deferred prosecution agreement with the Justice Department that should allow it to avoid having to exit certain business operations. Earlier Thursday, the bank’s Malaysian subsidiary formally plead guilty for its role in the 1MDB debacle, admitting to one count of conspiracy to violate the Foreign Corrupt Practices Act.

“Goldman Sachs today accepted responsibility for its role in a conspiracy to bribe high-ranking foreign officials to obtain lucrative underwriting and other business relating to 1MDB,” Acting Assistant Attorney General Brian C. Rabbitt of the Justice Department’s Criminal Division said in a release. The announcement “requires Goldman Sachs to admit wrongdoing and pay nearly three billion dollars in penalties, fines, and disgorgement, holds the bank accountable for this criminal scheme.”

The deal resolves an issue that has weighed on CEO David Solomon since he took over from predecessor Lloyd Blankfein two years ago. Goldman was accused of helping a corrupt Malaysian financier steal billions of dollars from the $6.5 billion 1MDB development fund, money that was supposed to help build the country’s economy.

Instead, the 1MDB funds were allegedly used by Malaysian financier Low Taek Jho to fund an epic spending spree, including a $250 million yacht, a stake in the Martin Scorsese film “The Wolf of Wall Street” and property around the world. At least $1 billion of the funds were used to bribe Malaysian and Abu Dhabi officials, U.S. officials said Thursday.

Goldman bankers reaped about $600 million in fees to facilitate bond deals in 2012 and 2013 that funded 1MDB, an amount that fixed-income professionals have said was unusually high.

Goldman admitted that it failed to take “reasonable steps” to make sure that Low, a known risk at the time, wasn’t involved in the three bond deals, the Justice Department said in its release. The bank also ignored red flags that came up during due diligence in pursuit of fees, authorities said.

A deal with U.S. agencies was expected since the start of 2020, but negotiations reportedly dragged on as the bank sought to avoid having to plead guilty in the case.

In July, Goldman announced a $3.9 billion settlement with the Malaysian government to settle a criminal probe over the bank’s role in the episode. That included a $2.5 billion cash payment and the bank’s guarantee that Malaysia will receive at least $1.4 billion in proceeds from seized assets.

This story is developing. Please check back for updates.

Source: CNBC