The “war” between Asia and Europe to “close” gas contracts is heating up, increasing the risk that the price of this particular commodity will continue to rise, pushing users more difficult before the crisis. cost of living crisis.

Japan and South Korea – the world’s 2nd and 3rd largest liquefied natural gas (LNG) importers are looking to secure supplies for the winter months and beyond due to fears of price hikes at the end of the year. as European demand increases.

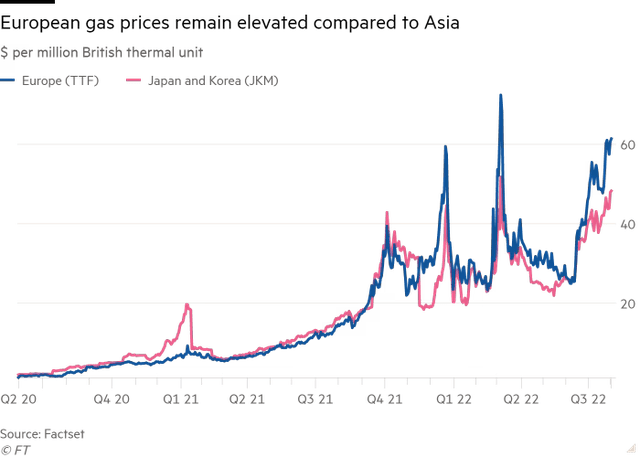

Meanwhile, Europe is also “panic” consolidating goods to find ways to replace natural gas supplied through pipelines from Russia. The price of natural gas in Europe has increased nearly five times from a year ago. This hit the pockets of consumers as well as service companies.

“What we’re seeing is an unprecedented scramble to secure LNG shipments through the end of this year and into 2023,” said the CEO of an Asia-based gas company. “This scramble hasn’t had too much of an impact on prices yet, but that’s going to happen sooner or later as late buyers will bear the brunt of the price.”

There have been strong consolidation activities from Japan and Korea for contracts in November, December and January 2023, said Toby Copson, global head of sales and consulting at Trident LNG.

Japan and South Korea “have problems” with energy security. They’re really concerned about what’s going to happen in the short, medium and long term, Copson said. “I think this year and the first quarter of next year, you will see strong competition between Europe and Asia in the market.”

Asia is still the destination of high-end LNG contracts with China, Japan and South Korea being the world’s three largest importers. However, TTF, Europe’s benchmark gas price, is currently significantly higher than Asia’s due to the region’s growing demand. Since the end of July, Russian gas flows from the Nord Stream 1 pipeline have reduced capacity to 20%. Officials in the region fear supply will be even lower.

Higher LNG prices in Europe mean traders have more incentive to sell here to make a profit. The price difference is so large that in some cases, long-term contract traders in Asia are willing to cut their existing contracts, accept penalties, but still make more profits when selling in Europe.

The supply that Europe and Asia are “scrambled” for is LNG from the US. The country exported 74% of LNG to Europe in the first four months of this year, compared with an average of 34% last year, according to the Energy Information Administration. Asia is the main destination for US LNG in 2020 and 2021.

The current competition means “there will come a time when Asia will have to pay a higher price” to attract LNG, one trader said.

China – the world’s largest importer of LNG – remains “settled” in the market, but traders say it looks like a “joke”.

Gas demand in China is generally low due to the blockades and the country has also “doed a great job in reducing its reliance on spot LNG contracts”, according to Alex Siow, a leading gas analyst. Asia at consulting firm ICIS said. China is even selling off unused LNG, easing some of the tension in the market.

However, the trader said the market is still well aware of the risks as Chinese companies “come in at the last minute” to buy LNG. “As winter approaches, countries like Japan and South Korea need to rebuild storage,” said Samatha Dart, head of gas research at Goldman Sachs.

“As China’s economic activity starts to recover more clearly, you will see a significant shift in the balance of LNG,” she said.

Source: FT

Source: Vietnam Insider