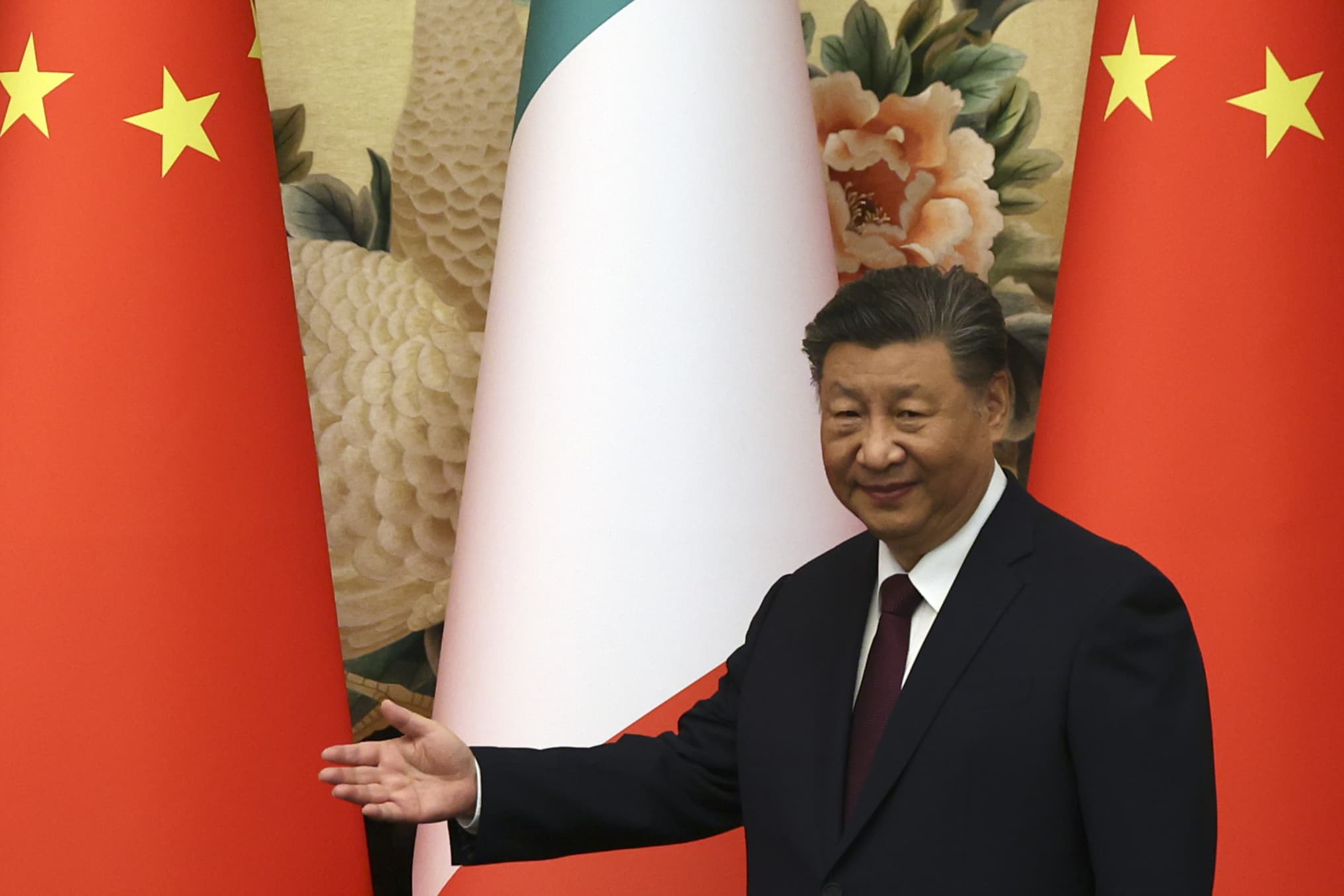

Chinese President Xi Jinping and other top leaders are gearing up for the annual central economic work conference, reportedly set to take place this week, as Beijing strives to boost growth.

While an official date for the two-day conclave has yet to be announced, Bloomberg has reported that the closed-door meeting will be held from Dec. 11 to 12. Usually, the annual conference is preceded by the high-profile gathering of the Politburo, the top decision making body led by president Xi.

During both meetings, top policymakers will review economic performance and policy implementation in the current year, while setting priorities for the following year, economists at Goldman Sachs said.

The central government will also discuss its growth target and budget for 2025, partly to give local governments a guidance for setting their own targets ahead of the annual parliament session early next year, according to Goldman Sachs.

While the specific numbers will not be announced until March, it is widely expected that Beijing will keep its next year’s GDP growth target at “around 5%” — same as the current year — if not slightly lower.

“If history is any guide, policymakers may leave the 2025 growth target unchanged at around 5% or lower it to 4.5-5%,” said Larry Hu, chief China economist at Macquarie, adding that Chinese policymakers have never lowered target by more than 0.5 percentage points in the past.

China’s government has rarely failed to meet its growth targets, with only two exceptions where growth fell significantly short of the target, in 1990 and 2022, according to Lynn Song, chief economist at ING.

Stimulus steps

While China’s economy is on track to achieve this year’s growth target of “around 5%,” it is still contending with several longer-term problems, including a prolonged housing downturn, tepid domestic consumption and escalation in trade tensions with the U.S. as Donald Trump returns to the White House.

Chinese officials have ramped up stimulus announcements since late September, including several interest rate cuts, looser property purchase rules, and liquidity support for stock markets.

Recent data indicated that existing stimulus measures have worked to lift some aspects of the economy, but were still not enough to offset persistent deflationary pressures.

In November the country’s already near-zero consumer price inflation fell to a five-month low, and a deflation in wholesale prices deepened further, with the producer price index falling for the 26th straight month, data on Monday showed.

The country’s persistent consumption slowdown traces back to the country’s real estate slump and its deep ties to local government finances.

Last month, Chinese Minister of Finance announced a $1.4 trillion package to alleviate the local governments’ debt crisis.

The authorities need to further expand the scale of the debt swap program, economists at Morgan Stanley said in a note, given that local government financial vehicle debt was at nearly half of the country’s GDP.

Beijing is also expected to widen its fiscal deficit by 1.4 percentage point, which would allow more central government borrowing to shore up the economy, according to Morgan Stanley.

Even as the fiscal deficit widened to 3.8% in Oct. 2023 with the issuance of special bonds, authorities in March reverted to their deficit target of 3%.

Growing headwinds

In the face of additional tariffs, the Chinese leadership may consider larger fiscal packages next year “in a multiple stage fashion” as it monitors and reacts to U.S. policy, economists from Barclays said in a note.

Trump, who takes office in January 2025, has said he will impose an additional 10% tariffs on Chinese goods unless Beijing does more to stop the trafficking of the highly addictive narcotic fentanyl. He had also threatened to impose tariffs in excess of 60% on Chinese goods during his election campaign trial.

The latest tariff threat is likely a “tactic to push China to the negotiation table,” Barclays economists said, predicting the president-elect would eventually only deliver 30% additional tariffs. That, still, could create a drag of up to 1-percentage-point in China’s GDP, they added.

“A policy bazooka could arrive if the Trump tariffs hit China’s exports hard,” Macquarie’s Hu said, adding that Beijing will have to stimulate domestic demand to achieve its growth target.

Exports and manufacturing sectors can no longer power the economy to achieve annual growth of 4% to 5% in the next decade, Hu added, “they have simply become too large to drive growth in the long run” and exports face more risks from trade tensions.

China needs to boost consumption to be the main growth driver, Hu stressed, by tackling unemployment and raising labor income, as well as providing more for the low-income groups. “A reasonable target is for household consumption to reach 50% of GDP,” Hu said.

Investing in China

China’s government bonds have been on a tear amid expectations of further interest rate cuts and weak economic fundamentals. The 10-year yields recently dropped below the psychological benchmark of 2% to hit a multi-decade low.

Chinese government has attempted to stem the bond rally, fueled by pessimism about its economy and a lack of attractive investment options.

“The market is still pricing in some fiscal stimulus support early next year,” said Edmund Goh, investment director at abrdn. Despite some encouraging signs of recovery in China’s property market, “we didn’t see any improvement in domestic economic data in the last few months,” Goh added.

On the equities front, Barry Gill, head of investment at UBS Asset Management said China is still his “top pick” given cheap valuations and “the most potential to surprise investors” on numerous fronts compared with other markets.

Chinese benchmark CSI 300 was down 0.5% Monday after jumping 1.3% last Friday to its highest level in two weeks, as some traders positioned for further stimulus at this week’s policy meeting.

“A more decisive stimulus response and a turnaround for the markets in the next 12-18 months could be in the cards,” the UBS asset management team said in an email.

— CNBC’s Evelyn Cheng contributed to this report.

Source: CNBC