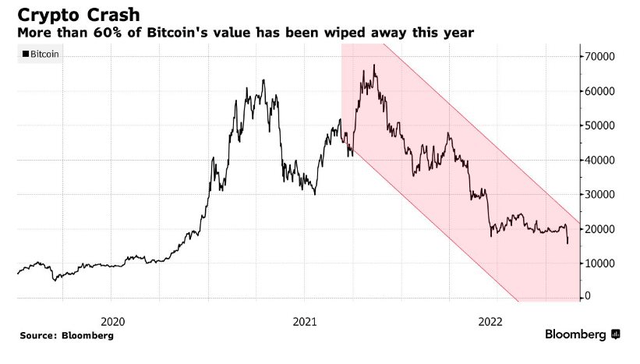

Even before Sam Bankman-Fried’s FTX exchange collapsed, investors were fed up with cryptocurrencies. The FTX shock may have permanently snuffed out hopes for investors to include cryptocurrencies in their portfolios.

While there are still many people who have not given up, many experts are saying that it is no longer correct to treat cryptocurrencies as a portfolio diversifier or digital gold wallet. Experts say the losses are too great and the market structure too risky.

Portfolio manager Hani Redha at Pinebridge Investments in London, said: “Cryptocurrencies have no place in institutional asset allocation. There was a time when cryptocurrencies were seen as a potential asset class that every investor should have a portfolio. Now even cryptocurrencies are not considered.”

The crashes and scandals of the past few months have rendered all the arguments of crypto advocates futile. All have abandoned the notion of Bitcoin as a safe haven in times of uncertainty.

From the collapse of TerraUSD to the bankruptcy of Celsius, nothing has been as terrifying as the crash of FTX. The failure of FTX is raising questions about the viability of the crypto ecosystem.

Salman Ahmed, investment strategist at Fidelity International, says that setting up an investment strategy that includes cryptocurrencies has always been difficult and is increasingly under pressure. His company in February launched a Bitcoin trading product aimed at professional traders in Europe. But that product has lost about 55% since its inception.

Just a year ago, the crypto craze reached its peak. Bitcoin hits a record of $67,000. In January, Bridgewater estimated 5% of Bitcoin holders were institutional investors.

At that time, exaggerated predictions appeared everywhere. JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou. once wrote that Bitcoin could theoretically hit $146,000 in the long term.

A PWC survey from April found that 42% of crypto hedge funds expect Bitcoin to trade between $75,000 and $100,000 by the end of 2022.

Up to now, the views of investors have been moderated. Strategist Panigirtzoglou thinks Bitcoin could return to summer lows of $13,000. “The argument that investing in cryptocurrencies is for diversification is gone” he said in an interview.

Bitcoin once crashed then recovered. Some believe that the cryptocurrency market will eventually mature. An analyst at Morgan Stanley thinks the FTX issue could benefit established companies with experience in risk management.

However, for investment expert Mark Dowding of BlueBay Asset Management, it is a myth that Bitcoin is like digital gold. It is only a matter of time before investors lose money and the price of cryptocurrencies plunge again. “The idea of an industry that produces nothing, burns cash but delivers attractive returns from the start has failed” he said.

According to Bloomberg

Source: Vietnam Insider