SINGAPORE — Asia-Pacific stocks were mixed on Friday, following days of turbulent trading this week as investors continue to monitor the situation surrounding the omicron Covid variant.

Chinese tech stocks in Hong Kong plunged after ride-hailing giant Didi announced Friday that it will begin taking steps to delist from the New York Stock Exchange — less than six months after it made its debut stateside. The company also said in the statement that it will pursue a listing in Hong Kong.

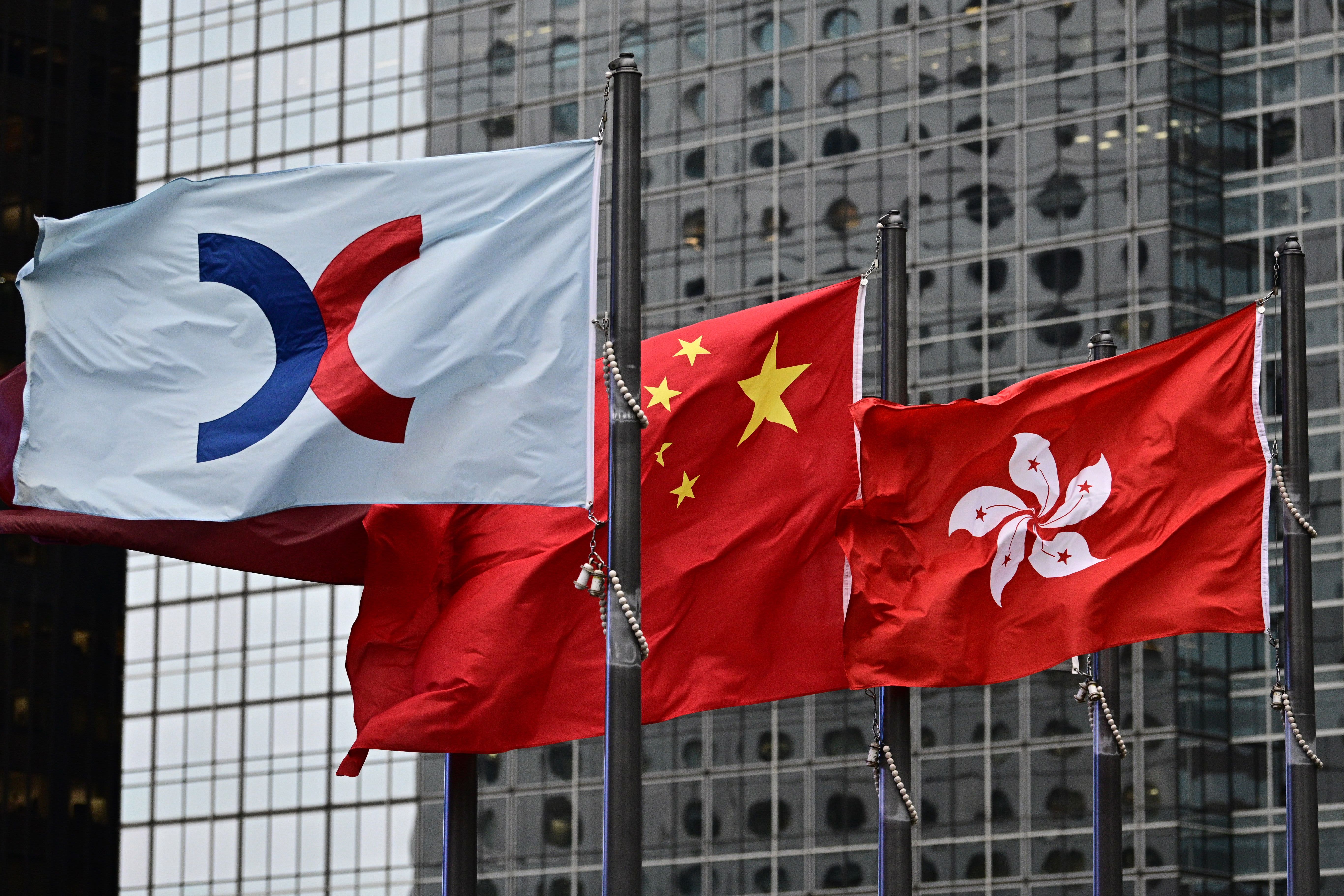

Shares of Tencent in Hong Kong fell 2.32% while Alibaba dropped 2.61% and Meituan slipped 2.66%. The Hang Seng Tech index declined 1.53% to 5,925.52.

Hong Kong’s broader Hang Seng index ended the trading day about 0.1% lower at 23,766.69.

Mainland Chinese stocks closed higher, with the Shanghai composite rising 0.94% to 3,607.43 while the Shenzhen component climbed 0.857% to 14,892.05.

In Japan, the Nikkei 225 closed 1% higher at 28,029.57 while the Topix index gained 1.63% to finish the trading day at 1,957.86. Shares of conglomerate SoftBank Group, which holds a sizable stake in Didi, shed 0.71%.

South Korea’s Kospi climbed 0.78% to close at 2,968.33.

Shares in Australia also rose as the S&P/ASX 200 advanced 0.22% on the day to 7,241.20.

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.34%.

Shares on Wall Street saw a sharp rebound overnight, with the Dow Jones Industrial Average surging 617.75 points to 34,639.79 while the S&P 500 gained 1.42% to 4,577.10. The Nasdaq Composite climbed 0.83% to 15,381.32.

Oil jumps more than 2%

Oil prices were higher in the afternoon of Asia trading hours, with international benchmark Brent crude futures rising 2.57% to $71.46 per barrel. U.S. crude futures surged 2.69% to $68.29 per barrel.

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 96.238 after a recent recovery from below 96.

The Japanese yen traded at 113.40 per dollar, still stronger than levels above 113.4 seen against the greenback earlier this week. The Australian dollar was at $0.7063, off levels above $0.715 seen earlier in the week.

Source: CNBC