Asia-Pacific markets fell on Thursday, with tech stocks dragging South Korean and Taiwanese indexes after chipmaker Nvidia reported its second-quarter results.

Nvidia reported second-quarter earnings — ended July — that beat Wall Street expectations and provided stronger-than-expected guidance for the current quarter. The company also authorized an additional share buyback of $50 billion.

Revenue for the second quarter came in at $30 billion, up 15% from the previous quarter and 122% higher from a year ago. However, the firm’s shares fell 8% in extended trading.

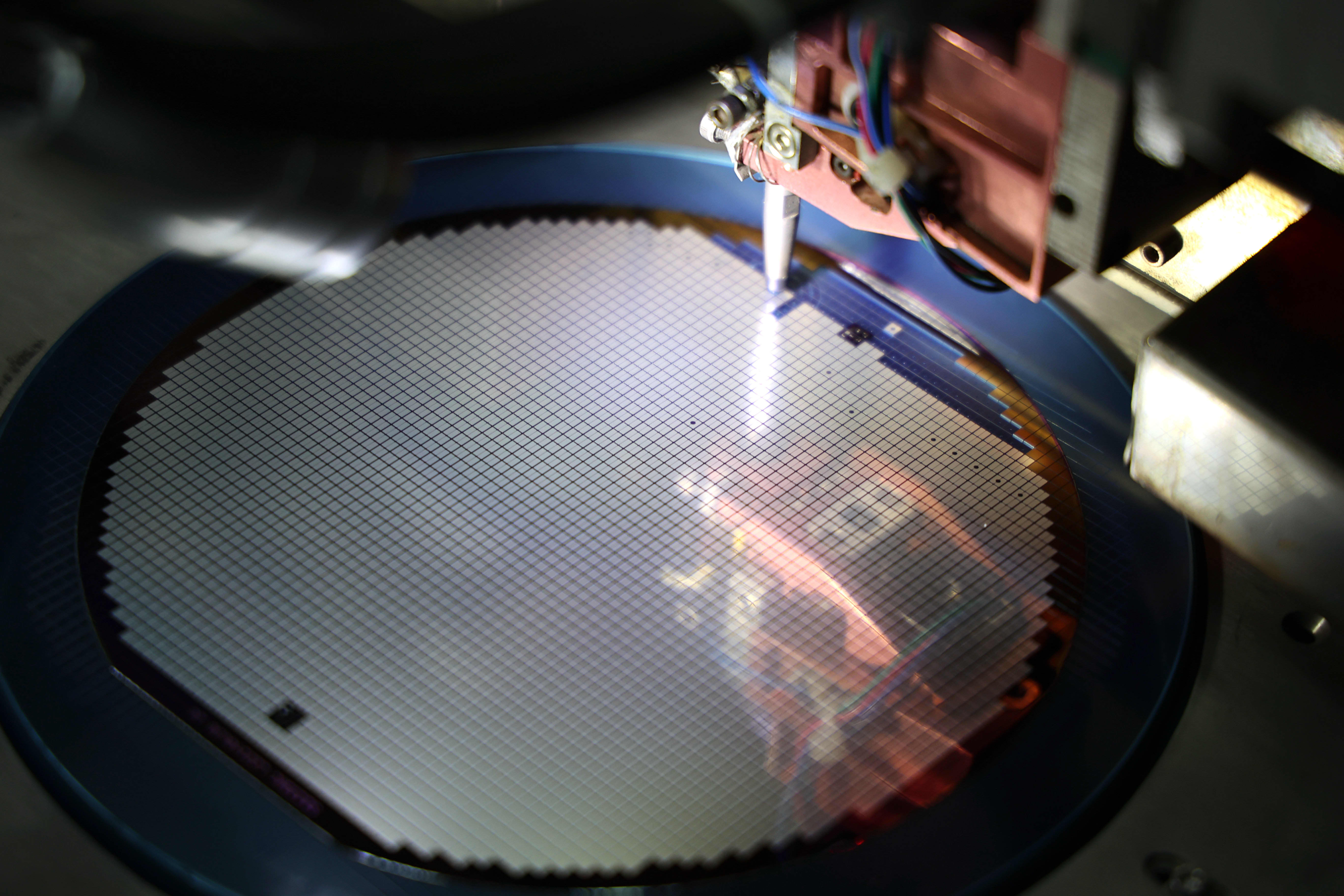

Investors in Asia will watch for any spillover to tech stocks in the region, which is home to companies along Nvidia’s value chain like Taiwan Semiconductor Manufacturing Company and SK Hynix.

South Korean chip heavyweight SK Hynix plunged over 5%, while Samsung Electronics fell more than 2.6%, dragging the Kospi down 0.71%. The small-cap Kosdaq was down 0.74%.

The Taiwan Weighted Index lost 1.14%, leading losses in Asia. Taiwan Semiconductor Manufacturing Company shares shed 2.07%, while Hon Hai Precision Industry — known internationally as Foxconn dropped 2.16%.

Japan’s Nikkei 225 dropped 0.42%, while the broad based Topix was down 0.24%.

Australia’s S&P/ASX 200 was down 0.67%.

Hong Kong Hang Seng index slipped 0.4%, with the mainland Chinese CSI 300 losing 0.31%.

Overnight in the U.S., all three major indexes fell in the regular trading session and before Nvidia’s results, with the Nasdaq Composite down 1.12%, while the S&P 500 slipped 0.6%.

The Dow Jones Industrial Average lost 159.08 points, or 0.39%.

—CNBC’s Lisa Kailai Han, Hakyung Kim and Kif Leswing contributed to this report.

Source: CNBC