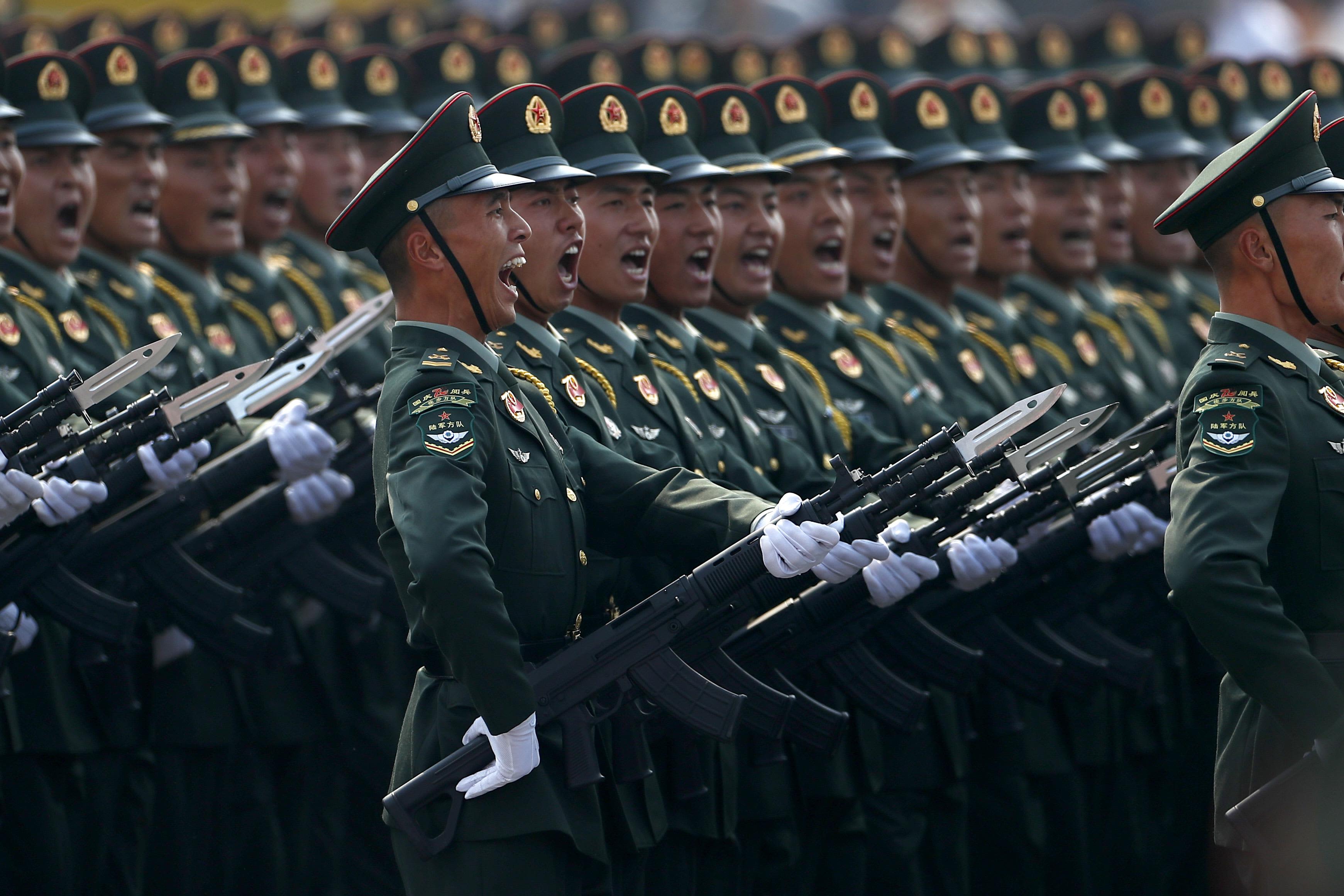

Soldiers of the People’s Liberation Army march during a parade to celebrate the 70th anniversary of the People’s Republic of China at Tiananmen Square on October 1, 2019 in Beijing, China.

Fu Tian | China News Service | Visual China Group | Getty Images

SINGAPORE — Major Chinese companies that are crucial to Beijing’s global trade and infrastructure projects are under threat as U.S.-China tensions escalate — and that could mean more risks for American investors, according to research firm TS Lombard.

Last month, U.S. President Donald Trump issued an executive order prohibiting U.S. investments into a list of Chinese companies that Washington said were owned or controlled by the Chinese military. On Monday, Reuters reported that the Trump administration will be adding China’s top chipmaker SMIC and oil and gas producer CNOOC to that list.

Following that report, shares of CNOOC plunged nearly 14% on Monday, while SMIC fell almost 3% the same day. Both stocks extended their losses on Tuesday.

The U.S. is also close to releasing a so-called blacklist of 89 Chinese companies with military ties, restricting them from buying a range of American goods and technology, according to another Reuters report last week, which cited a separate draft list.

Many of the Chinese firms on the list are central to China’s Belt and Road (BRI) initiative, according to U.K.-based research firm TS Lombard in a note last week.

The BRI initiative is a massive project that’s building an extensive network of rail, road and sea routes stretching from China to Central Asia, Africa and Europe. It is also aimed at boosting trade with countries participating in this initiative.

TS Lombard said that among the Chinese companies that were blacklisted, American investors have the highest direct exposure to China Communications Construction Company, China State Construction Group, China Railway Construction Corporation, and China Telecommunications.

While large state-owned companies dominate the list, it also includes private companies that have longstanding contracts with China’s military or its armed police, such as tech giant Huawei and video surveillance firm Hikvision, TS Lombard said.

Investors are also waiting for more clarity on how the U.S. executive order would apply to listed subsidiaries of state-owned Chinese companies under the blacklist, the research firm noted.

Investors subject to more risks

What’s worrying is that China is seeking “synergies” between commercial and military technologies in the long run, TS Lombard said. That means private Chinese companies are “co-opted into the strengthening” of the People’s Liberation Army (PLA), the country’s armed forces.

In China’s latest five-year plan that was announced last month, Beijing reaffirmed the national “urgency” of “consolidating military, political, military and civilian unity” in order to make its national defense and military more efficient, TS Lombard noted.

To that end, that plan outlined the Chinese government’s intent to use technologies to disrupt the military’s combat methods.

“Private-sector tech companies are being called upon to innovate technology with the potential to disrupt the status-quo of warfare,” the firm said. Some of those technologies include autonomous combat robots and quantum radar communications systems.

The implications are that investors would be subject to risks that are not immediately obvious – where companies not directly linked to China’s military could also be eventually blacklisted by the U.S.

“As Beijing intensifies its policy of civil-military integration, the risk for investors is that the US will (respond) with ever broader definitions,” warned TS Lombard. That could mean including entities that supply the Chinese army as well as the armed police — “even if their business is non-military,” the research note said.

Firms that provide food and medical supplies may be included, it said.

Blacklists put Biden in a tough position

U.S. President-elect Joe Biden would likely want to spend his initial six months in office trying to “rebuild” Washington’s relationship with Beijing, said William Reinsch, senior adviser at think-tank the Center for Strategic and International Studies.

“I think that what you’ll see out of Biden … not to look for unravelling … but also not to look for new sanctions and new actions, at least in the short run,” he told CNBC’s “Squawk Box Asia” on Tuesday.

Trump, though, could “make everything worse in the short run” by adding more Chinese companies to the lists before leaving office, Reinsch said. That “creates a kind of a problem” for Biden.

“That would put Biden in an awkward position … I think he’ll be reluctant to add more, but I think he’ll also be reluctant to remove the ones that’s been added,” he added.

But since the lists were created on the basis of national security, Biden would not want to be accused of being “soft on China” when it comes to security, Reinsch said.

“So it would put him in a bit of a box,” he said.

Source: CNBC