Inflation has become a hot topic even on the dinner table as prices for food, energy, and almost everything Americans use every day have risen. According to data released by the US Department of Labor on June 10, CPI in May increased by 8.6% compared to a year ago and increased by 1% compared to April, exceeding experts’ estimates. Now, many economists fear that the US will face a crisis like the 1970s, when the average inflation rate for the whole decade was 7.1%, negatively impacting household finances and the economy.

This is a huge shock to a generation of consumers accustomed to low or no inflation. Bloomberg Economics estimates that US households will have to spend an extra $5,200 this year, or about $433 a month, on the same basket of everyday consumer products.

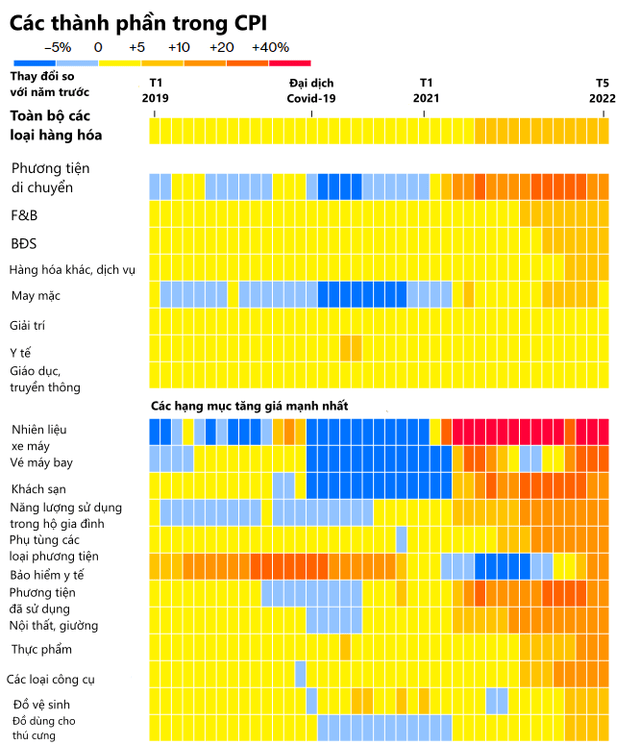

The reasons for the skyrocketing prices are supply chain disruptions because of the pandemic leading to shortages of goods, the Russia-Ukraine conflict affecting the supply of important commodities, and people and businesses receiving trillions of dollars in government support. What remains uncertain is how long high inflation will last and what its long-term effects will be. The answer can be given by looking at the factors that are driving commodity prices.

The price of WTI oil has more than doubled from about 40 USD/barrel in 2020 to more than 120 USD at one point. Accordingly, the price of gasoline in the US has increased to a record high of nearly 5 USD/gallon, according to the American Automobile Association.

Same goes for food prices in the US. Any resident who goes to the grocery store will notice the prices of most things go up, even in the double digits. Just last year, items like pasta, certain meats, fresh vegetables, flour and butter dropped in price. But this trend did not.

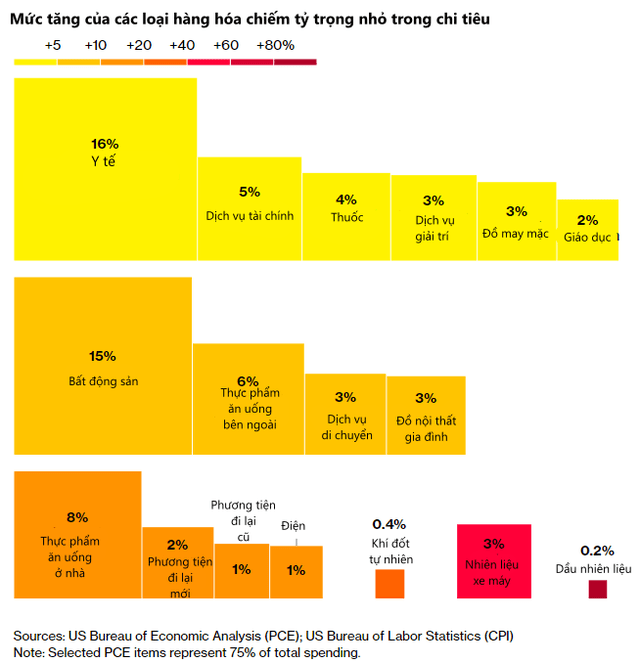

However, in terms of the average person’s spending in the US, the items with a lower proportion of prices have the largest increase in prices. Overall, however, at least 16% of personal spending is on items that have seen more than double-digit price increases over the past few months, including motor fuel, which has increased 49% and 107% for diesel. whether in May.

Cost of goods

According to Bloomberg, while many items are more expensive now than they were in 1998, incomes have grown faster during this period.

In terms of energy, the average price of household utilities such as cooking gas and electricity makes up a small portion of income. But in recent months, consumers have paid 1.5 times as much to fill up their gas tanks, and fuel oil accounts for more than double their share of income.

In terms of meats, those like steak, bacon, and roast are more expensive. However, chicken, pork ribs and some other types of beef are priced lower than before.

Meanwhile, many agricultural goods are more affordable, such as fresh tomatoes, strawberries and bananas. Orange juice and malt beverages are more expensive relative to income, and the price of wine has risen only slightly. Rice, the world’s most important food staple, is also cheaper as a share of consumers’ incomes. So are other staples like whole milk, pasta, flour and bread.

Average spending by income level

Of course, the high prices of these goods are not really a big deal for people with high incomes. In fact, for more than half of Americans – with an income of $64,557 or more, even a 10% increase in spending doesn’t mean they’ll go hungry or have to sell their home. As for the richest people, they still have a lot of money when total spending increases by 10%.

In USD terms, people with lower incomes also spend less on housing, transportation, food and medical expenses than those with higher incomes. But these essentials make up a higher percentage of their spending. In other words, low-income people can’t cut spending even if the high-income group doesn’t need to.

Wage growth

After years of wage increases with little or no increase, the rate of increase for the lowest-wage workers group is at its highest. However, income inequality remains a big problem: The 6% increase for workers earning $27,026 in 2020 is less than $2,000; The group with an income of $273,739 had a comparable increase of more than $8,000.

However, wage growth has not kept pace with inflation. While nominal personal disposable income is being driven by rising wages, real disposable income in the United States is falling. Accordingly, the purchasing power of consumers is decreasing.

Household Finance

Overall, Americans’ financial well-being is at its best ever, thanks to the government’s fiscal stimulus programs that boosted asset values. U.S. household wealth has increased by $38.6 trillion since the pandemic broke out to $149.3 trillion in the first quarter. The 35% increase in the nine quarters is roughly the same as the previous six years combined.

In addition, Americans also have significant savings, which will help them cope with high inflation. Deposits by households and nonprofits grew to $4.47 trillion in March from $1.30 trillion two years ago.

As a percentage of disposable income, household net worth is at its highest, up about 50% since the financial crisis. One lesson that Americans learned after the crisis was to avoid the risk of too much debt. As a result, they have worked to reduce debt, which now accounts for 9% of disposable income compared with a record of more than 13% in 2007.

Apart from a few times that are considered exceptional, inflation has been almost non-existent since the early 1990s. This situation has caused the Fed to worry about preventing deflation. For a long time, the American people have not faced such high inflation as they are now and of course now they cannot avoid being surprised when prices rise so quickly.

Refer to Bloomberg

Source: Vietnam Insider