SINGAPORE — Stocks in Asia-Pacific were mostly higher in Friday trade as the Pentagon added more Chinese firms to a blacklist of alleged Chinese military companies.

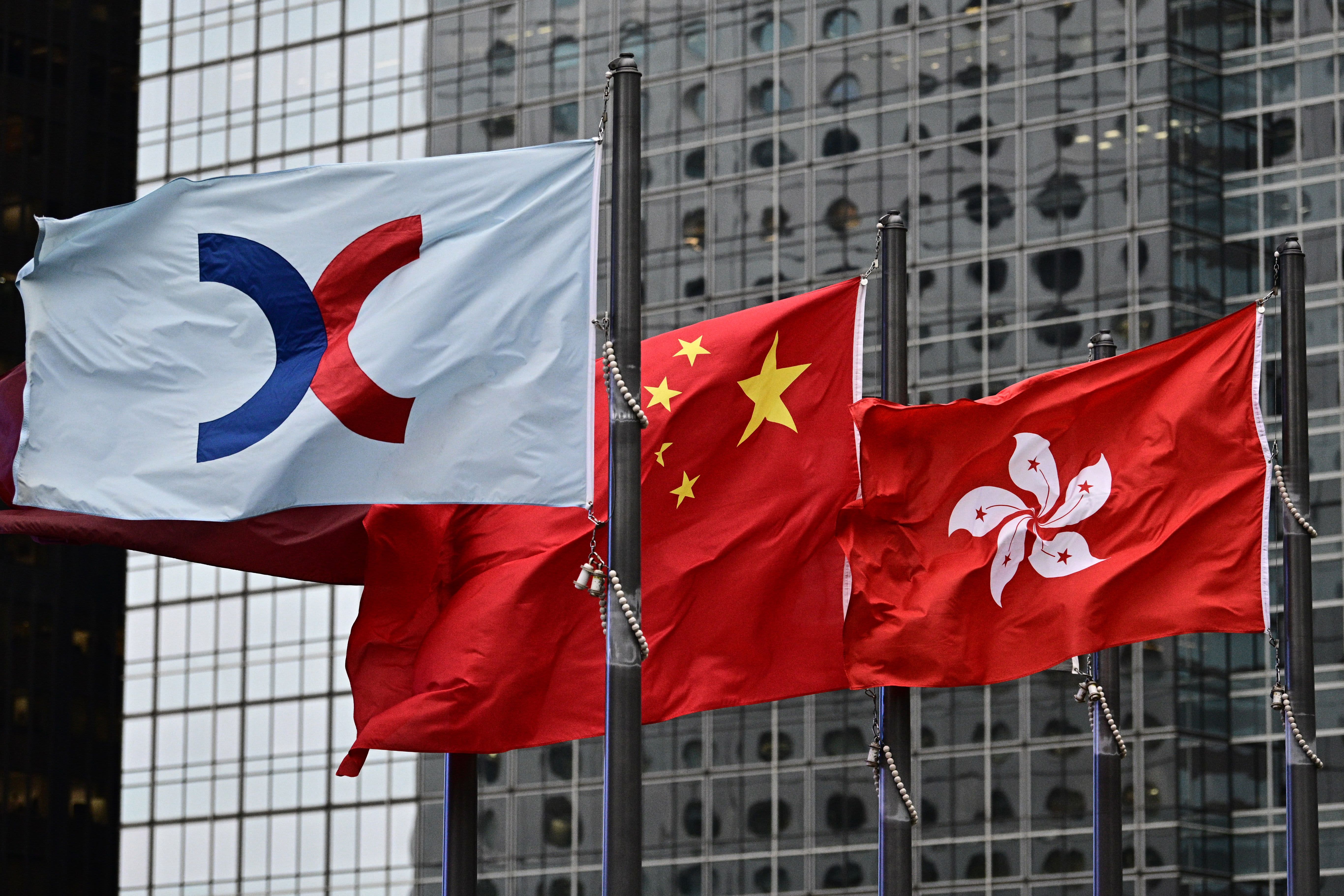

Mainland Chinese stocks closed higher even though they saw losses during the trading day. The Shanghai composite is up slightly and closed at 3,444.58 while the Shenzhen component advanced 0.4% to end the day at 14,026.66. Hong Kong’s Hang Seng index finished its trading day 0.4% higher at 26,835.92.

Chinas largest chipmaker Semiconductor Manufacturing International Corp and oil producer CNOOC were among firms added to the blacklist. Hong Kong-listed shares of SMIC plunged 5.41% on Friday after an earlier suspension. CNOOC, or China National Offshore Oil Corp., also saw its Hong Kong-listed stock fall 3.9%.

Elsewhere in Asia, South Korea’s Kospi led gains among the region’s major markets and jumped 1.31% to close at 2,731.45.

In Japan, the Nikkei 225 slipped 0.22% to close at 26,751.24 while the Topix finished its trading day slightly higher at 1,775.94.

Shares in Australia edged higher on the day, and the S&P/ASX 200 gained 0.28% to 6,634.10. Australia’s retail turnover rose 1.4% month-on-month in October on a seasonally adjusted basis, according to figures from the country’s Bureau of Statistics.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.79%.

Vaccine watch

Oil prices jump

Oil prices were higher in the afternoon of Asia trading hours, with international benchmark Brent crude futures up 2.09% to $49.73 per barrel. U.S. crude futures also gained 1.77% to $46.45 per barrel.

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 90.60 following its decline earlier this week from levels above 91.5.

The Japanese yen traded at 103.91 per dollar after strengthening sharply yesterday from levels above 104 against the greenback. The Australian dollar changed hands at $0.7431, having risen from levels below $0.74 earlier in the trading week.

— CNBC’s Berkeley Lovelace Jr. contributed to this report.

Source: CNBC