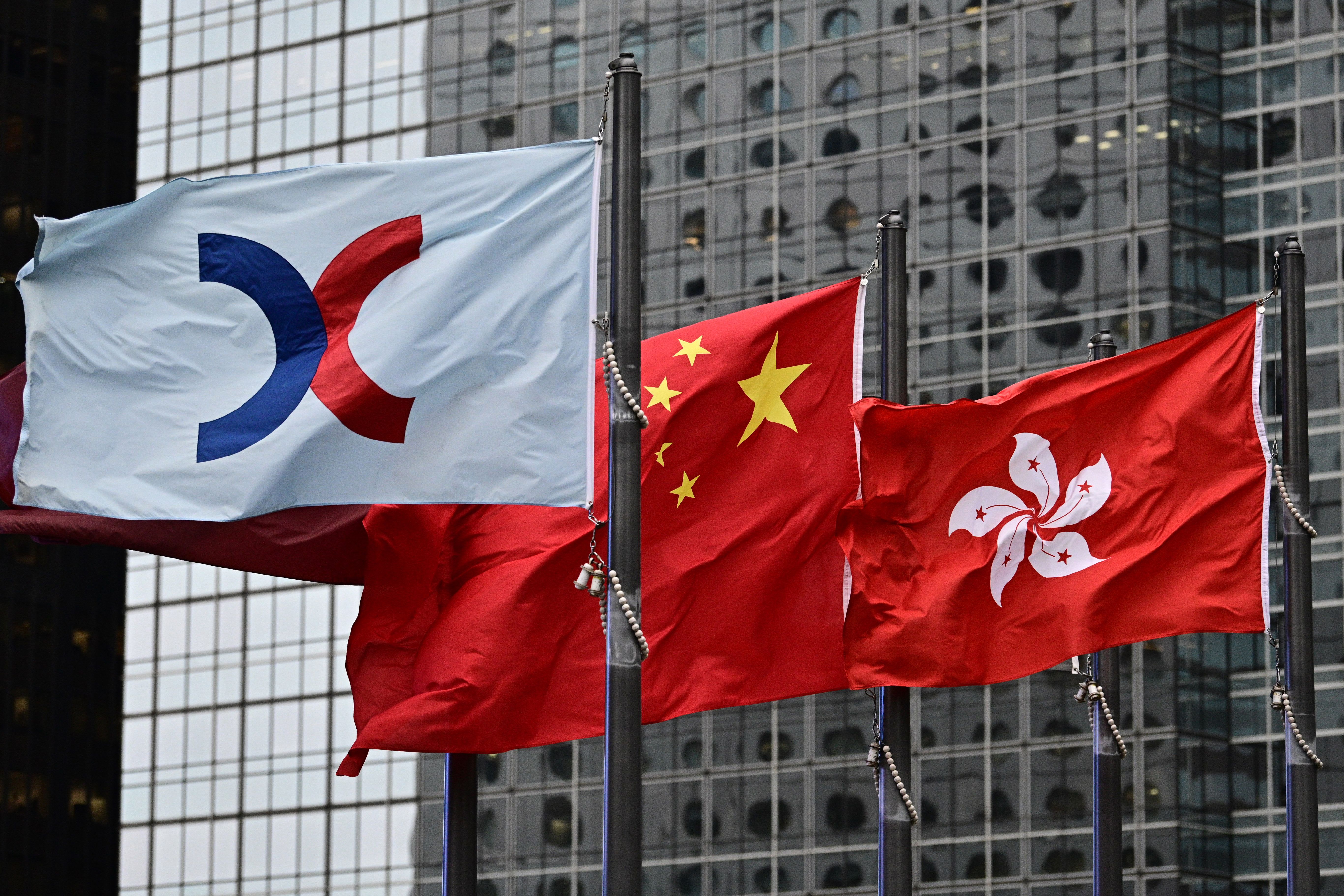

SINGAPORE — Hong Kong-listed shares of Chinese chipmaker SMIC fell in Monday trade following reports that the U.S. has imposed restrictions on exports to the firm due to risks of military use.

Shares of SMIC listed in the city dropped 5.81% by Monday afternoon.

Meanwhile, shares of China Evergrande Group in Hong Kong soared nearly 12%. That came after the firm announced Friday that its “operations remain stable and healthy while financial conditions remain sound.”

Evergrande shares in Hong Kong had seen a Friday plunge on the back of reports on a leaked document that showed the Chinese property developer was seeking government support to approve a restructuring plan, warning of an impending cash crunch.

Overall, the Hang Seng index rose 0.74%, with shares of Xiaomi rising more than 2%.

Mainland Chinese stocks lagged, with the Shanghai composite down 0.22% while the Shenzhen component shed 0.429%.

China’s industrial profits rose 19.1% in August, the country’s National Bureau of Statistics announced over the weekend. Chinese economic data has been watched by investors for signs of the country’s continued recovery from the coronavirus pandemic.

Elsewhere in Japan, the Nikkei 225 added 0.56% while the Topix index gained 0.57%. South Korea’s Kospi rose 1.47%, with entertainment shares in the country jumping after K-pop sensation BTS’ label Big Hit Entertainment priced its anticipated IPO at the top end of the range.

Over in Australia, the S&P/ASX 200 was above the flatline.

Overall, the MSCI Asia ex-Japan index rose 0.63%.

Meanwhile, the situation surrounding the pandemic elsewhere could also weigh on investor sentiment. Europe is now facing the prospect of a double-dip recession as it grapples with a coronavirus second wave. Over in the U.S., new daily coronavirus cases topped 1,000 in New York state on Saturday — the first time new infections in the state passed the 1,000 mark since early June.

Currencies and oil

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 94.478 after rising from levels below 93.0 last week.

The Japanese yen traded at 105.35 per dollar following an earlier low of 105.68 against the greenback. The Australian dollar changed hands at $0.7058 after sliding from levels above $0.72 last week.

Oil prices were lower in the afternoon of Asian trading hours, with international benchmark Brent crude futures down 0.74% to $41.61 per barrel. U.S. crude futures also shed 0.77% to $39.94 per barrel.

— CNBC’s Yun Li contributed to this report.

Source: CNBC