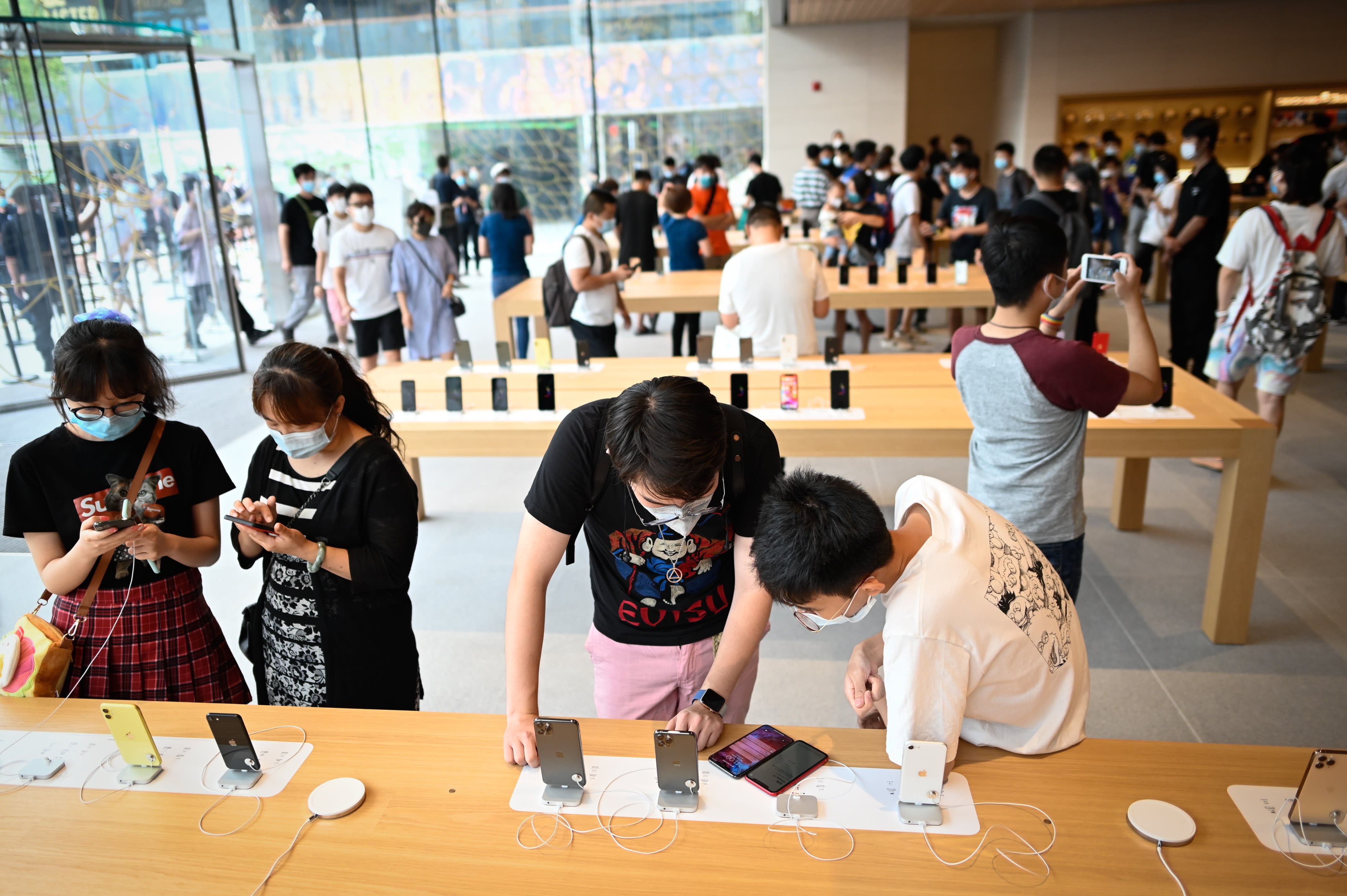

The purchasing power of the Chinese consumer remains relatively robust but uncertainty from the coronavirus pandemic still lingers, according to Tai Hui, Asia chief market strategist at JPMorgan Asset Management.

China may have missed analysts’ expectations in June’s retail sales numbers, but Chinese consumers “are still in reasonably good shape,” Hui told CNBC’s “Squawk Box” on Friday.

However, “I think it’s the consumer sentiment that’s been impacted by for example, the very brief outbreak in Beijing last month,” he said.

A “key issue” remains over whether Chinese citizens are “feeling more comfortable” to travel domestically again, Hui said, pointing to increased chatter surrounding topics such as summer holiday bookings for Chinese tourists domestically.

“We’re gonna see a little bit more signs of recovery in the consumer sector in the third quarter,” particularly when some of the worst hit sectors and services “come back online,” Hui said.

His comments came on the back of data released Thursday that showed weak consumption in China. Retail sales in June fell 1.8% on year, missing expectations for a 0.3% rise by economists polled by Reuters. June’s retail sales numbers followed the 2.8% on-year decline in May.

China economy’s second quarter rebound

Commenting on the likelihood of a change in policy stance by Chinese authorities following Thursday’s economic data, Hui said: “I don’t think the authorities (are) going to swing from one end to the other in such a drastic manner.”

“If you listen to the National Bureau of Statistics, they’re still very cautious towards the second half outlook especially from the external demand perspective,” he said.

Private manufacturing investment in China remains “pretty sluggish” due to uncertainty surrounding the coronavirus as well as weak external demand, Hui said.

Still, he acknowledged that areas such as public infrastructure spending are “picking up.”

“I do think that the authorities are still very much mindful of the downside risk to the economy but obviously they don’t want (an) asset bubble or debt-fueled boom,” he said.

From an economic management perspective, “you do want to have sufficient liquidity for the economy especially when … there’s still a lot of uncertainties in the second half of the year from a global … economic perspective,” Hui said.

Source: CNBC