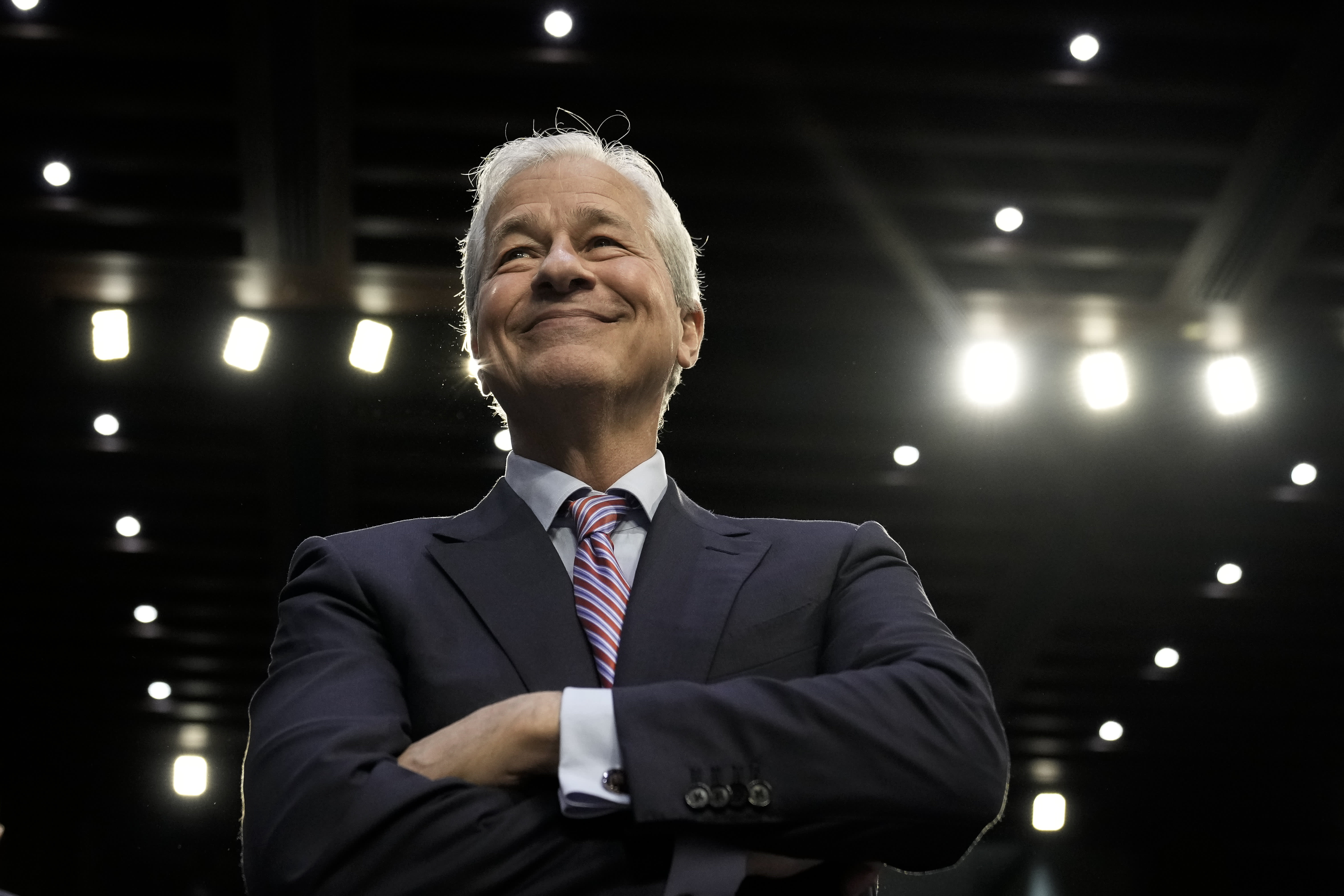

JPMorgan Chase‘s chairman and CEO, Jamie Dimon, says a “hard landing” for the U.S. cannot be ruled out.

When asked by CNBC’s Sri Jegarajah about the prospect of a hard landing, Dimon replied: “Could we actually see one? Of course, how could anyone who reads history say there’s no chance?”

The CEO was speaking at the JPMorgan Global China Summit in Shanghai.

Dimon said the worst outcome for the U.S. economy will be a “stagflation” scenario, where inflation continues to rise, but growth slows amid high unemployment.

“I look at the range of outcomes and again, the worst outcome for all of us is what you call stagflation, higher rates, recession. That means corporate profits will go down and we’ll get through all of that. I mean, the world has survived that but I just think the odds have been higher than other people think.”

However, Dimon said that “the consumer is still in good shape” — even if the economy slips into recession.

He pointed to the unemployment rate, which has been below 4% for about two years, adding that wages, home prices and stock prices have been going up.

That said, Dimon pointed out that consumer confidence levels are low. “It seems to be mostly because of inflation. …The extra money from Covid has been coming down. It’s still there, you know, at the bottom 50% it’s kind of gone. So it’s I’m going to call it normal, not bad.”

Minutes from the Fed’s May meeting released Wednesday showed that policymakers have grown more concerned about inflation, with members of the Federal Open Market Committee indicating they lacked confidence to ease monetary policy and cut rates.

Timing of Fed cuts

Dimon said interest rates could still go up “a little bit.”

“I think inflation is stickier than people think. I think the odds are higher than other people think, mostly because the huge amount of fiscal monetary stimulus is still in the system, and still maybe driving some of this liquidity.”

Is the world prepared for higher inflation? “Not really,” he warned.

According to the CME FedWatch Tool, about half of traders polled are pricing in a 25 basis points cut by September. The Fed has predicted three quarter-percentage cuts throughout 2024, but only if the market allows.

Asked about the prospect and timing of rate reductions, Dimon said that while market expectations “are pretty good. They’re not always right.”

“The world said [inflation] was going to stay at 2% all that time. Then it says it will go to 6%, then it said it’s going to go to four. … It’s been 100% wrong almost every single time. Why do you think this time is right?”

JPMorgan uses the implied curve to estimate interest rates, he said, adding: “I know it’s going to be wrong.

“So just because it says X, doesn’t mean it’s right. It’s always wrong. You go back to any inflection point of the economy ever, and people thought X and then they were dead wrong two years later,” he said.

Source: CNBC