World-renowned investors have all achieved great success. They are always different, and innovative and have a clear career path. What they all have in common is that they are all at the top of the market. But when investing, all 5 entrepreneurs will have their own strategies.

So what “exclusive” secrets do they have so that many investors can learn and apply in 2023?

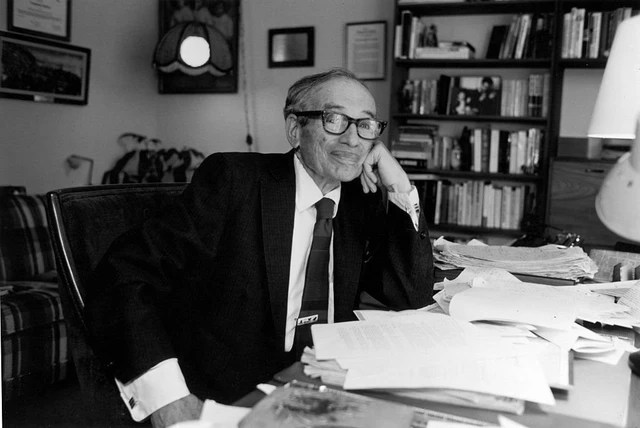

1. Benjamin Graham

Benjamin Graham (1894-1976) was a legendary American investor. He has achieved many outstanding achievements as an investment manager and financial educator. Benjamin has written two investment books worth a thousand years, including “Security Analysis” and “The Intelligent Investor”. He is also the teacher of many investment legends such as Warren Buffett, William J. Ruane or Irving Kahn.

Benjamin Graham is the one who coined the term “value investing”. This is the concept that explains that people should invest in stocks that are undervalued. If the stock is recognized for its full value, people can optimize profits.

Besides, Benjamin also always evaluates the market thoroughly. He will decide to invest only when he is sure that the value of the company is higher than the cost. In particular, he will sell if the company has reached the price that he thinks is reasonable. These are the two “golden” principles, although they have been around for a long time, they have never been wrong.

2. Bill Gross

Bill Gross, born in 1944, he is a world-famous American investor and is known as the “king of bonds” because of his successful fixed-income investments. He is also the co-founder of Pacific Investment Management Company (PIMCO).

Bill Gross says, “One of the most important financial decisions is finding the best person or best organization to invest your money in.”

He also advises that investors should not “pour money” into “zombie companies”. These are companies that are at least 10 years old and whose interest payments on loans exceed earnings before interest and taxes. That is, it needs to be continuously financed to maintain operations. Instead, investors should “pour” into the real economy with companies that are financially and ethically sound.

3. Peter Lynch

Peter Lynch (1944) is one of the greatest and most successful investors of all time. He is a former manager of the Magellan Foundation. At the age of 33, Peter Lynch took over and ran the fund for 13 years, until retiring at age 46. He has also co-authored numerous books on modern personal investment strategies in particular and research. investment in general.

In his investment journey, he once advised people: “Investment acumen cannot be learned from Wall Street experts. It’s something that’s available to everyone.” People need to “invest in what they understand.”

Besides, the legendary Peter Lynch also offers a set of 4 principles that are proven to work. First, “knowledge is power”. “The most important thing for me in the stock market, as anyone is, is that you know what you own,” he said.

When investing by buying shares of a company, do people understand how that company does business? How does the company make money, does it have a competitive advantage in the industry?

Second, “don’t let emotions rule”. Human emotions make life rich but are detrimental to investment. Emotions make people think short-term, have unrealistic expectations of profits both now and in the future. This can lead to common investment mistakes such as: rushing to sell stocks when the investment is underperforming or spending time waiting for a proportional loss.

Third, “must diversify the portfolio”. Investment is always risky, portfolio diversification is a condition for balance. The principle is “don’t put your eggs in one basket”, that is, don’t “pour” into similar investments too much.

Fourth, “buy low, sell high”. “I find when the stock market goes down, if you buy mutual funds wisely, at some point in the future, you get a surprise,” he said. These are 4 very useful tips for new investors in 2023.

4. Warren Buffett

Warren Buffett is known as the “Oracle of Omaha”, he is one of the most successful investors in history. His net worth of $100.6 billion (2021) comes mainly from stocks and the company Berkshire Hathaway.

Buffett always maintains the first heart and follows the discipline that he sets out. He advises investors to understand the business they want to “put their money in” and only buy stocks that people are willing to hold.

He also said people should prioritize businesses with a high competitive advantage – companies with quality products and well-developed. Finally, adhere to the safe investment limit. When planning your investments, make sure you keep an emergency reserve at all times. In particular, when choosing an investment portfolio, do not be too focused on stocks and bonds with too high returns because it may bring unexpected risks.

5. Jack Bogle

John C. Bogle is one of the most prominent investors in the world. He is the founder of Vanguard Group – one of the largest investment funds in the world, managing about 7 trillion USD (2021).

In the words of Tim Buckley, CEO of Vanguard, Jack Bogle has not only made an impact in the investment world, but he has also changed the lives of many individuals who are saving for their future or the future of their children. last name. “He’s their hero and mine,” said billionaire Warren Buffett.

In his career journey, Jack Bogle left 3 valuable lessons for those who are new to investing. Firstly, “investing is a good habit, everyone should invest as soon as possible”. Don’t leave money in one place, make it profitable. Even a small investment can skyrocket, never stop investing.

Second, “simplify investment, cut costs”. He advises people to follow the formula: “net return = gross return – taxes and fees”. To limit costs and taxes, he encourages people to invest in index funds (index funds) because the costs of management, trading and taxes of these funds will usually be lower.

Finally, “don’t be impulsive”. Let go of emotions when “pouring money”, set reasonable profit targets and stand your ground. Everyone should make the first decision based on the market reality and the situation of the people around them. Personal feelings should not be dominated, he said.

To get ready for 2023 with an impressive, safe investment with high returns, the secret that investor legends give is a guide for beginners.

Synthesis

Source: Vietnam Insider