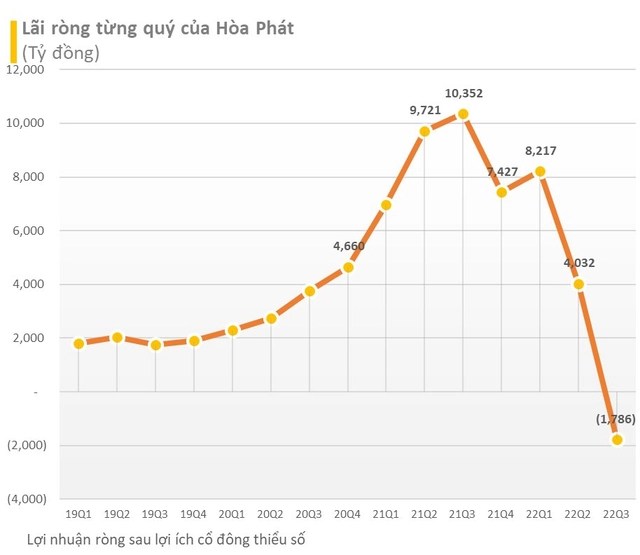

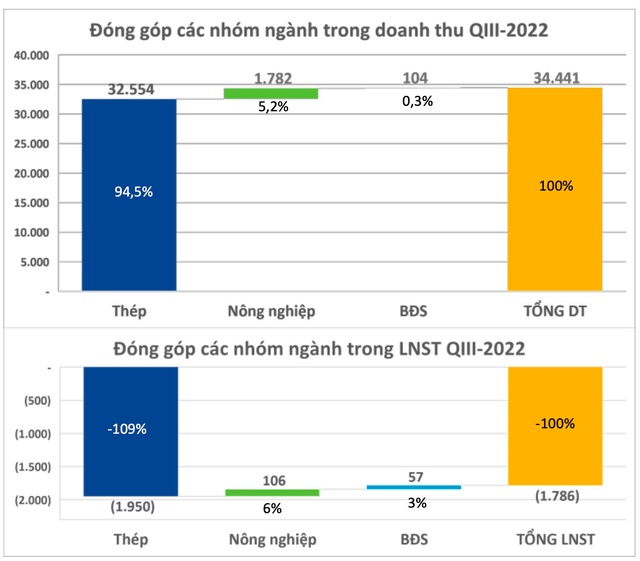

In the third quarter of 2022, the consolidated revenue of Hoa Phat Group (stock code: HPG) reached VND 34,441 billion, down VND 4,478 billion, equivalent to a decrease of 12% compared to the same period in 2021. As a result, Hoa Phat suffered a loss after tax consolidated VND 1,786 billion, while in the third quarter of last year, a profit of VND 10,350 billion.

According to the newly released quarterly business overview report, the revenue of steel production and trading – Hoa Phat’s key industry reached VND 32,554 billion in the third quarter, contributing 95% to the consolidated revenue, 5 The remaining % comes from agriculture and real estate.

However, the profit of steel group was negative to 1,950 billion dong. This is the second time since Q4/2008 steel group recorded a negative quarterly profit, thereby contributing up to 109% of Hoa Phat’s total consolidated after-tax loss and was offset by 6% profit from the group agriculture and 3% interest from Real Estate.

In terms of specific operations in the third quarter, in the context of difficulties and reduced consumption of the whole market, Hoa Phat maintained an increase in consumption of construction steel, hot-rolled coil, and steel pipes over the same period last year. In the first 9 months of 2022, Hoa Phat’s total crude steel consumption reached more than 6 million tons, of which 3.46 million tons of construction steel and 2.04 million tons of hot rolled coil (HRC). Output of steel pipe and corrugated iron reached 577 and 249 thousand tons, respectively.

Hoa Phat’s market share has been expanded in the first 6 months of 2022 and continues to maintain in the third quarter of 2022 at 36% for construction steel and 29% for steel pipes.

However, Hoa Phat is also forced to recognize that 2022 is a year full of difficulties for the steel industry. In which, the last 3rd quarter absorbed the consequences of negative impacts from the market on production and business results in the period.

After a particularly favorable year for steel production and trading in 2021, 2022 will experience global macro fluctuations such as war, post-Covid economic recession and inflation, causing negative impacts on the world economy long-term and at the same time rapid negative impact. In the face of objective adverse factors from the market, the third quarter of 2022 witnessed the entire steel industry enter a cyclical recession with gloomy colors in the business picture of all steel enterprises including steel companies. including Hoa Phat.

In the first three quarters of 2022, the Group’s gross profit margin declined at a rapid pace, from an optimistic figure of 23% in the first quarter to 3% in the third quarter, and the net profit margin decreased from 18% to the negative 5% current

Hoa Phat pointed out the mainfactors that negatively affected the steel industry in general as well as the Group’s operations in particular.

Firstly, the high price of raw materials in the second quarter was reflected in the production cost of steel in the third quarter, pushing up the cost of inventory.

Currently, coal and ore are the two most important raw materials for steel production by blast furnace technology that Hoa Phat is using. While iron ore has been falling since late 2021 and has remained at a comfortable level, coal prices have experienced strong fluctuations in the first nine months of the year, tripling their normal levels during two peaks in March and May and was only partially eliminated from falling ore prices.

Although the coal price has cooled down now, with a normal inventory turnover of about 3 months, the production cost of steel in the third quarter is still largely composed of imported coal purchased at the highest price in the second quarter was the main reason for Hoa Phat’s COGS in this quarter increased sharply by VND 6,290 billion, equivalent to 23% over the same period last year.

Second, sales volume increased, but steel prices continued to fall rapidly, causing revenue to decrease, plus cost of goods sold under additional pressure of inventory provision.

Inflation and economic recession weaken the world steel demand, from which the demand and domestic steel price are not out of this influence. In addition, the quiet domestic real estate market due to the tightening of credit in this industry also contributed to a sharp decline in Vietnam’s steel consumption.

According to statistics, the selling price of construction steel has undergone 19 downward adjustments since May 2022. The average selling price of construction steel in the third quarter decreased by 3%, of HRC by 26% and products from HRC such as steel pipes and corrugated iron decreased by 17% and 20% respectively over the same period last year. Hoa Phat’s sales volume increased but could not make up for the negative impact of selling prices, leading to a decrease in revenue.

In addition, in the context of continuously decreasing selling prices and high production costs, the inventory provisions in the previous quarter have not been reversed and must be additionally made in this quarter with the amount of VND 137 billion. Thus, in addition to the pressure on raw material costs, the Group’s cost of goods sold at the same time has to bear an additional burden from the inventory provision, contributing to further thinning of the profit margin in the third quarter of 2022.

Third, the tightening monetary policy to curb inflation caused interest rates to rise sharply, the USD exchange rate to climb, which increased financial costs of Hoa Phat.

The FED in September raised interest rates for the 5th time in a row in order to curb the very high inflation in the US. Although Vietnam’s credit market is holding a rather long lag on the effects of the tight monetary policy compared to the world, interest rates have also started to increase in the third quarter and are gradually putting pressure on borrowing costs. capital of enterprises.

Therefore, Hoa Phat’s borrowing interest rate started to increase in the third quarter, so even though the loan balance decreased compared to the previous quarter, interest expense this quarter still increased by 17% to 837 billion dong.

Besides interest, the exchange rate was the main reason leading to a significant increase in financial expenses of the Group in the third quarter of VND 1,341 billion, 2.4 times higher than the same period last year. With coal and iron ore materials mainly coming from imported sources and a part of loan balance in USD, Hoa Phat continued to record in this quarter the total realized net exchange rate difference loss and net exchange rate difference loss from the revaluation of monetary items denominated in foreign currencies is VND 1,013 billion.

However, in difficult market conditions and unpredictable factors, Hoa Phat focused on keeping consumption and tightening cost management. In difficult market conditions, the Group focuses on strict inventory management, while shortening the inventory period and reducing the proportion of raw materials. Inventories fell sharply by 13,537 billion dong compared to the end of Q2, to 44,779 billion dong at the end of 3rd quarter. In which, finished products, goods and unfinished products decreased by 1,030 billion dong, raw materials decreased by 12,224 billion dong. The length of the inventory turnover cycle has also been significantly shortened from 172 days to 126 days.

Currently, Hoa Phat maintains the number one market share in construction steel and domestic steel pipes. For exports, when demand in the US, Europe and China is weak, Hoa Phat focuses on exploiting other markets less affected by inflation and economic recession such as Southeast Asia and some other markets other countries in Asia.

On the other hand, with the domestic interest rate absorbing rapidly the world’s increase, Hoa Phat combined with tightening inventory management to adjust the working capital loan balance, flexibly balance the competitive advantage. on the borrowing price of foreign capital flows against the domestic currency and exchange rate risk to adjust the proportion of foreign currency loans in order to optimize financial costs.

Updating the progress of the projects, Hoa Phat said that the Dung Quat Complex – Phase 2 project with a total investment of 3 billion USD, with a capacity of 5.6 million tons of HRC, the largest project of the Group in 2022, is following on schedule. The main items of machinery and equipment (blast furnace, blowing furnace, rolling line…) have been signed. The basic premises will be handed over in October 2022. During difficult times, Hoa Phat prioritized to devote all its resources to ensure this biggest project.

Hoa Phat Container Project Phase 1 with a design capacity of 200,000 TEU/year in Ho Chi Minh City. Vung Tau started construction from April 2021. The project is expected to be completed in the third quarter and products will begin in the fourth quarter of 2022.

Source: CafeF

Source: Vietnam Insider