From the beginning of the week, HPG and NKG only slowed down in exactly one session on October 11 and “pocketed” a purple session. For the leading stock HPG, October 12 was the second ceiling gain of the year and the first purple session after more than 7 months since March 3. Meanwhile, HSG was even more prominent when it gained in a circuit of 4 sessions, of which 2 sessions increased in full range.

Despite strong gains in recent sessions, most steel stocks still fell very deeply from the peak, in which the trio of HPG, HSG, and NKG all lost about 55-65% compared to a year ago. The stock’s deep discount to a rare low valuation may have triggered the bottom-fishing cash flow of the steel group.

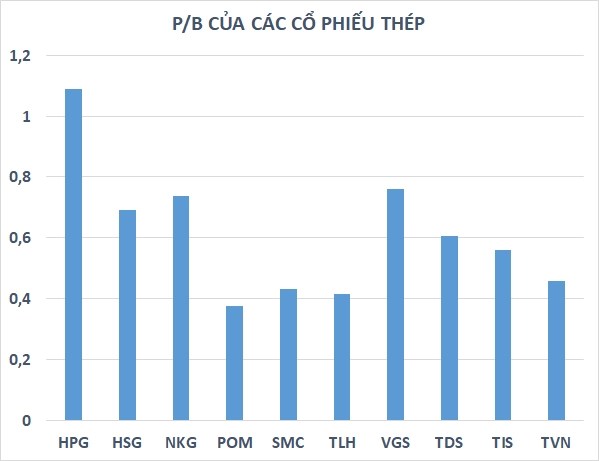

According to statistics, the valuation of most steel stocks is close to or even below book value. Especially for HPG, according to VNDirect’s assessment, a P/B of approximately 1 times is very rare, except in periods when the economy is facing a recession or a serious crisis like Covid-19, or a period of time when the economy is facing a recession. 2011-2012.

Basically, the recent strong rally has brought steel stocks through the most difficult period. However, it is hard to expect a really big wave when the steel industry still faces many challenges in the coming time, especially when the explosive growth cycle is over.

After the hot period at the end of last year, the world steel price has turned down sharply from the top and is tending to find the old bottom. Compared to the peak in October last year, the price of bar steel has decreased by about 36% and almost lost all the previous gains in 2021. Hot rolled coil (HRC) prices in the third quarter fell by 32% year-on-year.

Along with the above trend, the domestic construction steel price peaked at over 19 million dong/ton in April and May, and then continuously dropped to nearly 15 million dong/ton. On the other hand, the price of steelmaking coke reversed to increase again from mid-September. This will increase production input costs, affecting the gross profit margin of steel enterprises.

Typically, Hoa Phat, SSI Research estimates that the third-quarter after-tax profit of the leading steel company will reach about VND 2,100 billion, down 80% from the peak achieved in the third quarter of 2021. The main reason is due to falling steel prices, higher coke prices, increasing input costs and exchange rate losses. If SSI Research’s forecast is correct, the third quarter of this year will be the time when Hoa Phat’s after-tax profit drops to the lowest level within 11 quarters since the fourth quarter of 2019 when Covid-19 has not yet broken out.

On the other hand, according to Agriseco’s assessment, with the decrease in advance of many other commodities, steel price may find it difficult to drop sharply but favor the possibility of going sideways. This unit also considers the scenario that steel prices may increase slightly when China opens, the housing market is active again, leading to an increase in demand for construction materials.

In addition, Europe is currently facing an increasingly serious energy crisis when moves to cut gas supplies from Russia have caused a lot of damage. Rising energy prices have forced many European steelmakers to downsize or close their plants. It is estimated that this crisis can reduce the capacity of European steel companies by 3 million tons/year and help Vietnam’s steel enterprises to reduce competitive pressure in export markets and at the same time support the export market. steel subsidies in the future.

Besides, with China’s policy of cutting emissions and steel capacity, steel supply is forecasted to decrease gradually in the coming years. Therefore, VCBS expects when the steel demand outlook is positive again and forecasts that steel prices will recover in the second half of 2023 after falling to the current lower price level, caused by the stimulus policies. It will take time to show the effect of helping to revive the very weak demand of the Chinese market.

Source: Vietnam Insider