Land prices slow down

DKRA Vietnam has just released its August report on real estate market developments in Ho Chi Minh City and surrounding areas (Dong Nai, Long An, Binh Duong, Ba Ria – Vung Tau, Tay Ninh).

With the land plot segment, the supply of new products in the month reached the lowest level since the beginning of the year. Specifically, Ho Chi Minh City continues to be absent from the supply of new land plots, the projects are mainly land divided into individual plots, each plot has a book of each plot, the scale is less than 1-2ha.

Products in the region are mainly concentrated in Long An, Binh Duong and Dong Nai. However, most projects open for sale with a modest number of platforms.

5 projects opened for sale in the next phase in the month, providing 193 plots, of which 64 were sold, reaching the rate of 34%. Binh Duong has 90 plots, consuming two plots, the primary selling price ranges from 16.8 to 23.5 million VND/m2. Dong Nai has 9 plots, none of which are sold, the primary selling price ranges from 21 to 21.5 million VND/m2. Long An has 94 plots, consuming 62 plots, the primary selling price ranges from 16 to 24.4 million VND/m2.

The overall demand of the market continued to decrease compared to previous months (July 48% and June 54%). According to DKRA, the main reason is due to the strengthening of credit control in real estate.

The level of the primary selling price in the month is also assessed to have not changed much compared to the previous month and there is no difference between localities.

DKRA forecasts that the supply and demand for land plots in the next month will likely be better when the bottlenecks in credit sources are likely to be removed.

Customers are not interested in apartments

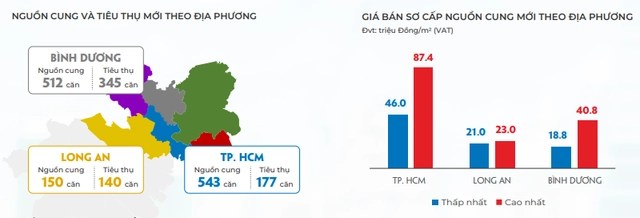

The apartment segment is limited in supply and has a poor absorption rate. Customers do not seem to be interested in this segment when the overall consumption rate of the whole market is only 55% in the context that shopping carts are only cautiously launched with 150-200 units. Particularly in Ho Chi Minh City, the absorption rate is only 22%, the lowest in the past 3 years.

Market supply also continued to decline. The whole region had 1,205 units opened for sale, only 50% compared to the previous month and 15% compared to May. Ho Chi Minh City and Binh Duong continued to lead the new supply structure, accounting for 45% and 42% respectively. new supply in the month. In Long An, affordable apartments (21-23 million VND/m2) appeared, attracting the attention of the market.

Apartment price level in Ho Chi Minh City is the lowest at 46 million VND/m2 and the highest at 87.4 million VND/m2, flat with market liquidity at a low level. This is influenced by commercial banks’ move to limit disbursement of loans to buy real estate. Particularly in some existing urban areas with synchronous utilities, rapid construction progress recorded an increase of 15 – 18% over the same period last year.

The report said that in the coming time, with the possibility that the restriction on disbursement of real estate loans is eased, the market may recover at the end of the year but it will be difficult to have a sudden change in the short term. Investors are moving the sale opening time to September to increase communication and booking time to optimize sales efficiency.

There is a phenomenon of price reduction in some projects

For townhouses and villas, the supply decreased sharply compared to the previous month, mainly in Dong Nai province (180 units) and mainly from the next phase of previously launched projects. Particularly, Ba Ria-Vung Tau and Tay Ninh continued to not record new supply.

The primary selling price did not change much compared to July. The secondary market was also less active, the liquidity was average, the price level did not change much, there was a local decrease in prices in some projects. Projects and investors are affected by cash flow.

Similarly, the supply of resort villas also decreased significantly compared to the previous month, with 22 units in the South (Ba Ria-Vung Tau), 97 units in the Central region (Binh Thuan) and 100 units in the North (Quang Ninh). Ninh, Hoa Binh, Phu Tho, Thanh Hoa).

Primary selling price recorded an increase of 2% compared to the previous month, of which the North fluctuated from 7.2-31.4 million VND/m2, the Central region 10.2-46.6 million VND/m2 and the South 17, 4-48.4 million VND/m2. However, it is accompanied by policies such as repurchase commitments, profit commitments, profit sharing, etc. of investors in order to stimulate market demand.

Condotel alone recorded a strong increase in supply compared to the same period last year, but it was still low and concentrated locally in 1 project in the central region (351 units). Market demand increased but was still quite low, most projects had slow sales, mainly concentrated in Binh Dinh.

The selling price of primary condotels increased by 2-7% compared to the previous month, ranging from 106.6-153.7 million VND/m2 in the North, 38.4-105.3 million VND/m2 in the Central region and 56.4-110.2 million VND in the South.

According to DKRA Vietnam expert, the difficulty of customers accessing loans from banks resonated with the psychological impact of the lunar July, which greatly affected the market demand. It is expected that in the last months of the year, supply and consumption will increase but there will not be many sudden changes.

Source: CafeF

Source: Vietnam Insider