With gold prices falling over the past week, sentiment among Wall Street analysts as well as investors on Main Street has turned to the downside, highlighting short-term downside risks.

Investors’ sell-off in gold over the past week is a continuation of a downtrend that began in early March, when the market reacted to the aggressive monetary policy action of the US Federal Reserve aimed at lowering the price of gold. inflation, which is still high.

On September 16, spot gold prices ended the week below the support price level – $1,680 – for the first time since April 2020, even breaking the threshold of $1,675 per ounce.

Ending this session, spot gold was at $1,672.48 per ounce, while December gold futures were at $1,683.50. For the whole week, the price of gold fell the most in four years, down about 2.5%, in the context of a strong dollar last week making gold more expensive for overseas buyers.

Up to now, the gold market has fully believed that the Fed will raise interest rates by 75 points at its meeting next week. However, inflation is likely to suddenly increase again, when the consumer price index in August 2022

Markets fully discounted the 75 basis point increase next week following the Federal Reserve’s monetary policy meeting; however, inflation was surprisingly resilient in August – with the Consumer Price Index up 8.3% year-on-year, well above expectations of an 8.1% increase, sending markets believes that there is a possibility that interest rates will be raised even higher, namely 1%.

Although gold is seen as a hedge against economic risks, rising interest rates make bullion less attractive.

Expectations that the US will continue to actively raise interest rates pushed the dollar up to a 20-year high, and 10-year US bond yields to 3.5%, the highest since April 2011.

Against this backdrop, many analysts believe that gold prices have been technically damaged and it is difficult for the precious metal to find any bullish momentum in the near term.

“Gold has been oversold, but the asset has generally not recovered quickly from the recent drop,” said Adrian Day, president of Adrian Day Asset Management.

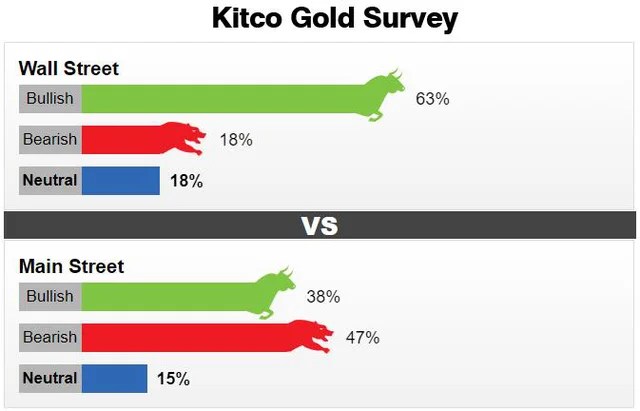

This week, a total of 22 market professionals participated in the Kitco News Wall Street survey. Of these, 14 analysts, or 63%, said they expect prices to fall next week; 4 people, or 18%, forecast price increases; and 4 others forecast flat prices.

Among Main Street retailers, 1,045 respondents took the online survey. Of which, a total of 395 people, or 38%, forecast an increase in prices; 489 people, or 47%, predict gold will fall; and the remaining 161 people, or 15%, forecast flat prices.

The bearish sentiment appeared when the gold price at one point fell to the lowest level in more than 2 years, at $1,661.90 an ounce in the last session of the week.

While the market generally predicts a drop in gold prices, the question is how far gold can fall, as many analysts note that $1,675 represents a significant level of support. A drop below this level will signal an end to gold’s three-year uptrend, according to analysts.

Some analysts expect the next support to be at $1,650. However, Colin Cieszynski, chief market strategist at SIA Wealth Management Inc, said there was little support for gold until it fell to $1,550 an ounce.

Marc Chandler, managing director of Bannockburn Global Forex, said the next target for gold prices would be $1,615 to $1,650, and would not rule out a drop to $1,500 next year.

While the chances of the Fed raising rates by 1% next week are very low, markets will see even more aggressive actions by the Fed throughout the rest of the year, Chandler said. , and note that markets now see the Fed raising rates until it reaches 4.50%.

“Risk assets are losing their appeal,” he said. “Gold is acting as a risk asset and should be treated as such. Let’s ignore the stories related to inflation avoidance and safe-haven.”

However, not everyone is predicting a drop in gold prices. Ole Hansen, head of commodity strategy at Saxo Bank, said that gold ending the week above $1,680 could signal a strong move in the market.

Mr. Hansen added that the Fed’s move to raise interest rates by 75 basis points could provide a bit of a rebound for gold prices.

“I’m also wondering how much more stocks need to fall before stagnant inflation starts to attract some attention,” he said.

Michael Moor, founder of Moor Analytics, also thinks that the gold sell-off may be running out of steam.

Traders may view a breakout of 1,680 as an extremely rare opportunity or a breakdown that prevents gold from rallying significantly.

The recent Fed action led to an increase in yields on US debt instruments and a strengthening of the dollar. However, the question is whether gold will break the lower levels further or, as before, will rebound significantly after that. According to technical studies, traders looking to buy gold will face two obvious outcomes; either a great success, or a catastrophic failure.

Reference: Kitco

Source: Vietnam Insider