After recording the strongest first half of the year in more than a decade, investors are flocking to shelters to avoid the impact of the stock market plunge. In addition, the market’s bet on the US economy’s ability to recover also “fuelled” the rise of the USD.

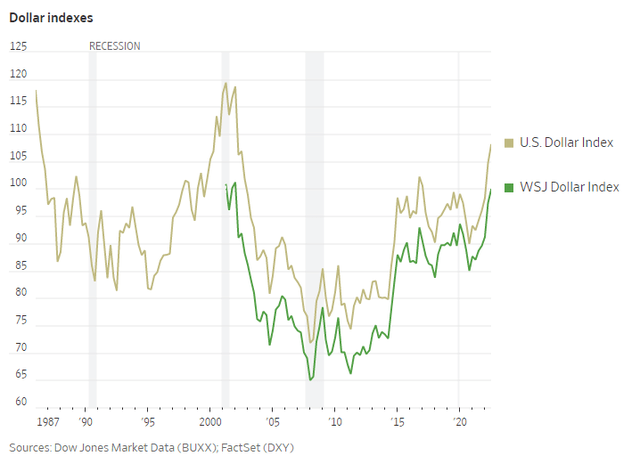

The WSJ Dollar Index, which tracks the dollar with a basket of 16 currencies, hit a 20-year high last week and is up nearly 2.5% this month. The EUR/USD exchange rate also hit its lowest level since 2002, the Japanese yen also fell to a bottom since the late 20th century.

Wall Street analysts expect the dollar to continue to appreciate as fears of a global recession intensify. Morgan Stanley raised its forecast for the dollar last week and now estimates the euro will trade at 97 cents by the end of September.

Michael Feroli, chief US economist at JPMorgan, said the minutes of the Fed’s June meeting further bolster the idea that the dollar is more likely to appreciate. Earlier this year, investors were uncertain whether the Fed would aggressively raise interest rates because the move could hurt the US economy. However, the minutes of the meeting showed that the Fed was ready to do whatever it took to “quench” inflation.

Asset managers are betting that the Federal Reserve (FED) will take tough measures to tame surging inflation. After last month’s CPI was announced, the Fed is said to be more likely to raise interest rates by 0.75 percentage points by the end of this month. While this is not as large as the 1% that many previously predicted, interest rates in the US and Europe, as well as in Japan, will continue to divergence. This can attract investors to the USD to hunt for profits.

Meanwhile, the strength of the dollar is a “double-edged sword” for American consumers and businesses. The more expensive dollar promotes domestic purchases, but affects the revenue of multinational companies. Recently, Microsoft lowered its revenue growth forecast for June, when two months earlier announced that a stronger dollar would cost them about $300 million in the first three months of the year.

A stronger dollar also affects the prices of commodities ranging from oil to copper, which are often priced in dollars. This negatively affects emerging markets, which are already saddled with USD-denominated debt.

This week, investors will be keeping a close eye on the financial reports of companies including Goldman Sachs, Tesla and Alcoa. These will be the first to report last quarter’s results with a bleak outlook and potentially falling profits, as executives see some signs of a recession looming. .

Asset managers are also watching the upcoming meeting of the European Central Bank (ECB) for signs of the euro’s upcoming movements. Analysts expect the ECB to raise interest rates for the first time since 2011.

Currently, the ECB and the Bank of Japan (BOJ) are still loosening monetary policy, unlike the Fed and central banks of other countries that are rapidly tightening to cool down inflation. The Bank of Canada also surprised when it raised interest rates by 1% last Wednesday.

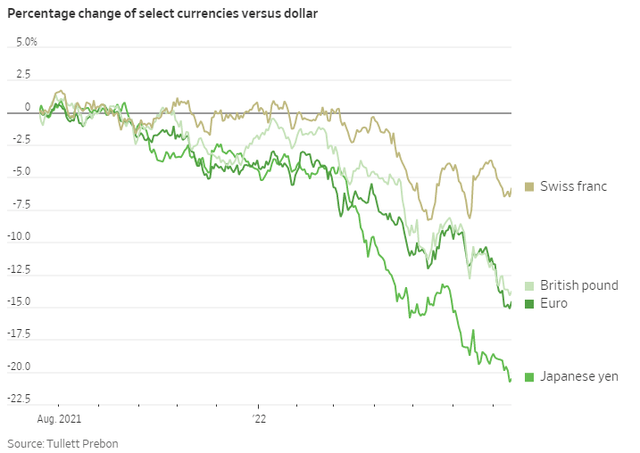

Hedge funds are making short bets on the euro, which has fallen nearly 15% against the dollar in the past year due to the impact of the Russia-Ukraine conflict, energy-related issues and inflation. . Data of Depository Trust & Clearing Corp. shows an increase in put volume as the euro falls rapidly.

Meanwhile, the yen continues to fall, falling about 20% against the USD in the past year. The BOJ has pledged to continue to pursue low-interest-rate policies, including controlling the spread between short- and long-term bonds (the yield curve), despite signs of already existing inflation.

“As the BOJ is not expected to adjust interest rates or its yield curve target, the yen’s performance will depend on changes in interest rates,” said Shaun Osborne, currency strategist at Scotiabank. US capacity.”

The effects of the dollar’s appreciation are spreading outside of Europe and Japan. Currencies that are used by traders to track sentiment towards growth prospects and equity markets, such as the AUD, have also fallen in recent days. The AUD has fallen more than 10% from its April high.

Steve Englander, head of North American macro strategy at Standard Chartered, said: “When investors change their mind, they also change their target with the dollar. Concerned about interest rates, inflation, Europe. Europe’s recession and corporate profits are taking a hit at the same time.”

Refer to WSJ

Source: Vietnam Insider