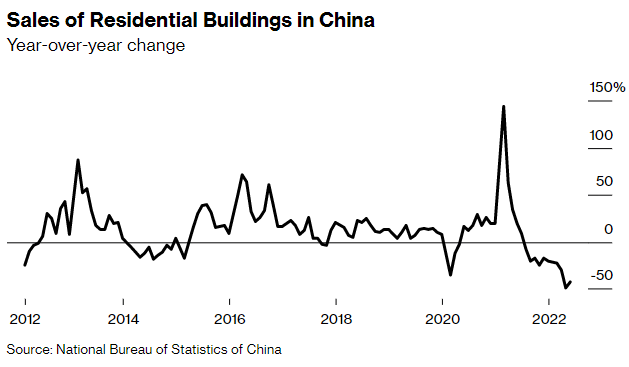

An index that tracks apartment and home sales in China has recorded a year-over-year decline for 11 straight months. This is a record level since China privatized the real estate market in the 1990s. When demand for services and goods derived from housing construction and sales accounted for about 20% of GDP. , this decline will be a big drag on the growth momentum this year of the world’s second-largest economy.

“This is the worst downturn ever recorded for the property sector,” said Lu Ting, chief China economist at Nomura Holdings. Prior to that, the recession that lasted from 2008 to 2014 hit global commodity markets as demand for Chinese imports of steel and copper faltered.

The plunge began last year when Beijing introduced new rules to tighten mortgage lending and developer funding. This is an effort to control rising house prices and reduce financial risks. President Xi Jinping has taken a hardline stance, while some economists say it will hamper real estate construction, which is at its peak, and drive GDP growth to less than 4% since now to the end of the decade.

The pace of decline in home sales in China is expected to improve slightly this year, as local governments ease restrictions to support growth. However, blockades in Shanghai and dozens of other cities since March have made the pace of decline this year more intense than in 2021.

Many of China’s biggest cities have eased restrictions on home purchases in recent months and the PBOC has also lowered mortgage rates to record lows. However, home sales in major cities are still down more than 40% from May due to blockades that shut down businesses and a spike in unemployment.

“The labor market needs to recover to revive demand. It depends a lot on China’s ability to impose future blockades,” said Iris Pang, China economist at ING Groep. ” She believes that home sales in China will not recover until 2023.

Xi and Chinese officials have so far taken a tough stance on the housing market. This is different from previous recessions, when real estate was used to boost the economy. At the April meeting, the leaders reiterated that “home is for living, not speculation”. According to Lu, this time, Beijing has placed a higher priority on controlling the real estate bubble.

5.5% growth target is ‘out of reach’

Problems with the real estate market are likely to cause China’s GDP growth to drop 1.4 percentage points this year, just 0.2 percentage points lower, according to Goldman Sachs economists. with the period when the economy was affected by the pandemic. Accordingly, China’s GDP in 2022 is about 5.5% is “out of reach”. Some economists say that reaching 3% is also a difficult thing.

China’s financial regulators have focused on ensuring developers’ defaults don’t trigger a financial crisis. Mortgage interest rates in Beijing are also much higher than they were after the 2014 slump. Chen Long, an economist at consulting firm Plenum, said government officials “don’t want to be like that.” cause if things get out of control again.”

Despite the sharp decline in sales and home construction, property prices in China have not fallen as much as in previous recessions. The reason is that excess supply remains low, which gives officials plenty of room to maintain tightening policies.

However, this decline has changed the business world. Real estate tycoons, among the country’s most lucrative business owners, have lost a total of $65 billion as of May 31, according to the Bloomberg Billionaires Index. State-owned property developers are playing a big role in construction, including buying unfinished projects from the struggling private sector, in an attempt to ease buyer sentiment.

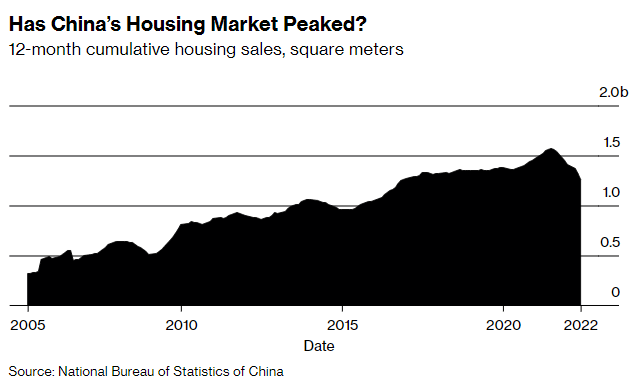

Some analysts expect home sales in China to recover slightly later this year, as cities continue to ease mortgage rules and other policies. Even so, Roseala Yao, an expert at Gavekal Dragonomics, thinks that home sales will fall by more than 10% this year from 2021 but may never return to the same increase as the past two years. “Consumption of steel and other building materials may reflect home sales, which continue to rise slightly and then decline from historic highs,” she said.

Even if Beijing wants to accelerate construction, the underlying conditions are not favorable. The process of large-scale urbanization in China has reached its limit. Population growth in big towns and cities fell below 1% last year for the first time since 1996.

According to research by the Lowy Institute – a consultancy in Sydney, housing inputs account for about 11% of China’s GDP and this figure will drop to nearly 7% by 2030. Other forms of investment such as infrastructure Floors and factory construction will not grow fast enough to fill the gap caused by a drop in spending on apartment construction.

Lowy’s research concludes that, while China may be able to avoid a financial crisis caused by a downturn in the real estate sector, the slowdown in activity will drag GDP growth to around 4% between now and the end. decade. “The deceleration of growth will clearly show that China cannot really become a substitute economic locomotive for the United States,” said Roland Rajah, chief economist at Lowy.

Source: CafeF

Source: Vietnam Insider