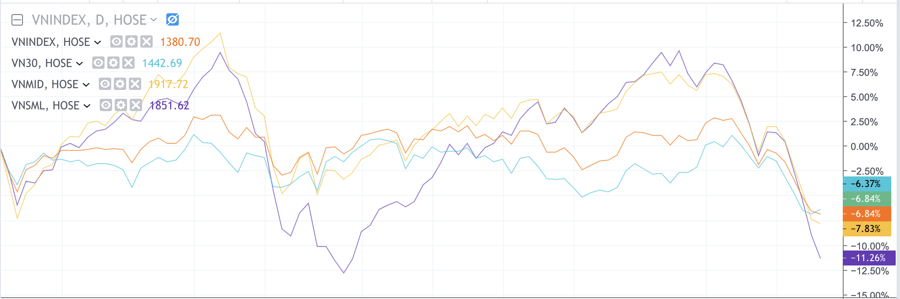

Since the beginning of April 2022, a number of events and negative information have impacted the Vietnamese stock market. The VN-Index decreased from 1,492.2 points at the end of March 2022 to 1,384.7 points on April 20, 2022, equivalent to a decrease of 7.2%. Thus, from the beginning of 2022 until now, Vn-Index has decreased by 7.6%.

VIETNAM STOCKS IS VERY HOT

In a letter just sent to investors, VinaCapital said that the drop in the stock market in Vietnam comes from three main reasons.

Firstly , on March 29, 2022, Chairman of FLC Group Trinh Van Quyet was prosecuted and arrested for allegedly manipulating and concealing securities information. Following that, on April 5, 2022, Chairman of Tan Hoang Minh Group was prosecuted for allegedly fraudulently appropriating assets, related to the issuance of bonds, and mobilizing money of investors through member companies of Tan Hoang Minh Group.

At the same time, the State Securities Commission has issued a decision to cancel 9 bond offerings from July 2021 to March 2022 with a total value of VND 10,030 billion of 3 Viet Star Companies, the Company. Winter Electricity, Soleil Company belongs to Tan Hoang Minh Group.

Secondly, the case of FLC Group and Tan Hoang Minh Group makes investors worry that the investigation will be extended to other companies, especially to companies suspected of manipulating stock prices. bonds and companies with bad financial situation, not transparent in issuing bonds. A series of speculative stocks, which have been growing hot since mid-2021, while their business results did not show any positive changes, were simultaneously sold off and plummeted.

That led to a large margin call sale in the past few days. Even stocks with good fundamentals are sold to pay off mortgages to buy securities, affecting the overall market.

Third, the macro situation did not have much positive support for the stock market in recent times. The conflict between Russia and Ukraine disrupted the supply of some basic goods, raising the risk of inflation.

Illustrated photo.

In the US, inflation in March 2022 reached 8.5% over the same period last year. High inflation will cause the US Federal Reserve to continue sharply raising interest rates. Some experts predict that the Fed will increase interest rates six more times in 2022. In addition, the outbreak of the Covid-19 epidemic in some parts of China, the blockade order in Shanghai also affects the situation. world economy. From the beginning of the year to April 19, 2022, the MSCI global stock index fell 8%.

With the VN-Index down 7.6% since the beginning of the year, VinaCapital believes that the Vietnamese stock market is at a very reasonable price for long-term investment. As of April 20, 2022, Vn-Index is having a P/E in 2022 of 12.2 times, much lower than the average of the last 5 years (14.5 times).

THE MARKET WILL SUCCESS THE RISK OF UP AND TO A NEW HIGH

According to VinaCapital, with the recovery of Vietnam’s economy after the Covid-19 epidemic, businesses on the Vietnamese stock market are forecasted to achieve an average profit growth of 22% in 2022, according to statistics of VinaCapital. Bloomberg. This is the most important driving force for the market to overcome the negative events in the short term and develop more positively in the rest of 2022.

Nếu nhìn lại những sự kiện tác động đến thị trường chứng khoán nêu trên, có thể thấy hầu hết những sự kiện này sẽ không kéo dài. Các ngân hàng trung ương trên thế giới có những công cụ hiệu quả để kiểm soát lạm phát. Hiện tại, giá cổ phiếu đã phần nào phản ánh ảnh hưởng của việc Fed tăng lãi suất. Theo thống kê trong quá khứ, việc Fed tăng lãi suất thường chỉ ảnh hưởng tiêu cực đến giá cổ phiếu trong 1-2 tháng, thị trường 1 năm sau đó hầu như đạt được mức cao hơn thời điểm trước khi tăng lãi suất.

Meanwhile, the investigation and handling of violations in the stock market, although affecting investor sentiment, especially for stocks subject to hot speculation, will be a positive factor. for the long-term development of the stock market. The strict sanction will increase investors’ confidence in the market, especially foreign investors who are aiming for the prospect of upgrading Vietnamese securities from the frontier market to the emerging market.

“In recent years, every year there have been a few negative events affecting the stock market, but with the positive outlook of the Vietnamese economy and listed companies, the market always overcomes difficulties to rose to new highs,” emphasized VinaCapital.

Source: vneconomy.vn

Source: Vietnam Insider