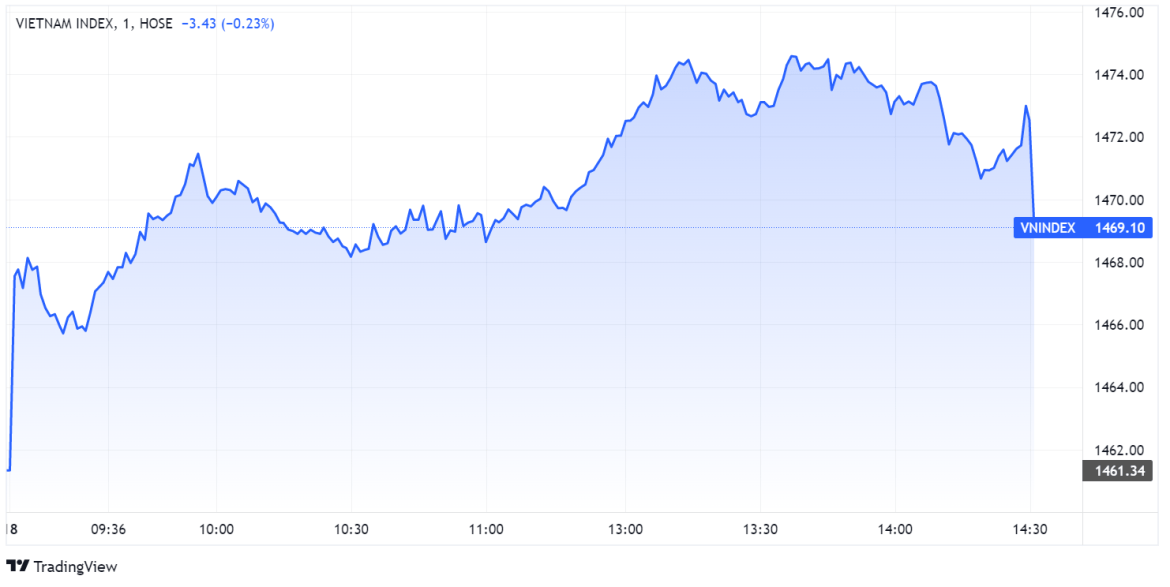

Following the slight gains in the previous sessions, the stock market at the end of the week continued to have positive movements to extend the series of 4 consecutive gaining sessions.

At the end of today’s trading day, VN-Index increased by 7.76 points (0.53%) to the upper area of 1,469 points. The floor had 228 advancers and 195 decliners.

Thus, the HoSE representative index has increased by nearly 23 points (nearly 1.6%) in the past 4 sessions. However, due to a large drop of over 20 points at the beginning of the week, the index in general only moved slightly in sideways trend.

While the HNX, when receiving an increase of 5.05 points (1.13%) to 451.21 points. This floor has 125 advancers and 110 decliners.

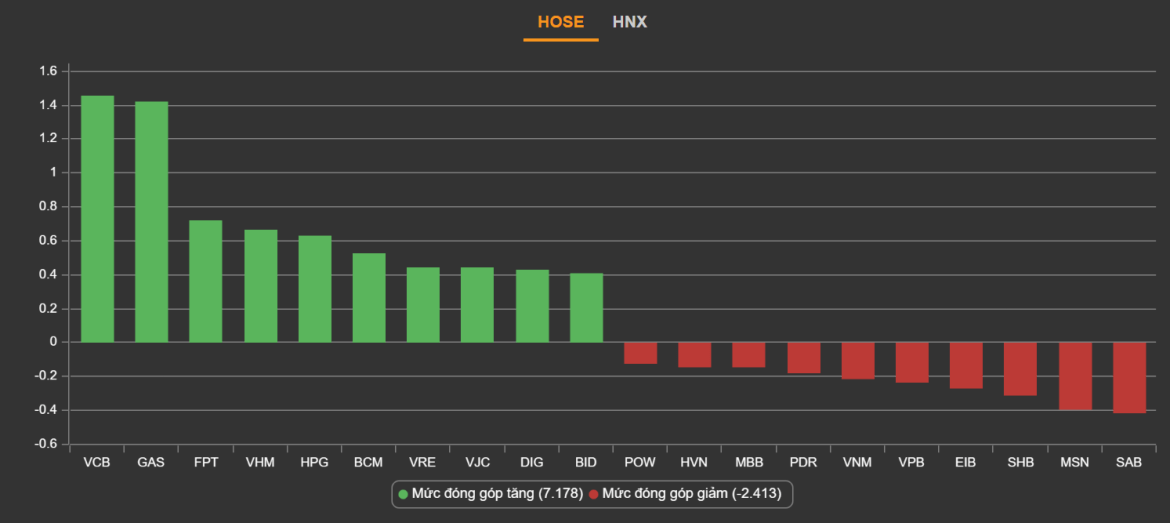

The index went up mainly thanks to the pull of large-cap codes. The VN30 basket today increased by more than 7 points (0.48%) with 18/30 stocks increasing, many of which increased by 2-3%.

For example, FPT increased by 3.4% to 95,100 dong, the fastest gainer in the VN30 group. This stock broke out after the company announced its profit plan this year, which is expected to increase 20% to 7,618 billion dong .

Or like PV Gas’s GAS increased by 2.7% to 108,900 dong thanks to the benefit of the strong recovery in world oil prices. Besides, many other oil and gas codes also made a breakthrough such as PXS gaining to the limit, PXT gaining 4.4%, PVD gaining 3.2% or BSR gaining 3.1%…

Hoa Phat’s HPG stock also attracted attention when it increased by 1.2% to 46,500 dong. Yesterday, the group announced that it had signed contracts with 8 major banks to arrange a credit syndication of VND 35,000 billion for the Hoa Phat Dung Quat 2 iron and steel production complex project.

Not only the large-cap group but also many small and medium-cap stocks also had good momentum. For example, FLC traded with the highest volume in the market with nearly 43 million shares and the market price increased by 2.6% to 14,000 dong. ROS in the same group also increased by 1.4% with more than 30 million shares changed hands. Or like DAG and OGC overbought at ceiling price in large volume.

Emerging stocks related to DNP Corp remained very positive. In which, HUT, VC9, DNP, NVT still ended in purple, only JVC was sold to reference level.

Real estate stocks also receive the attention of large cash flow. In which, Hoang Quan’s HQC increased by 5.6% to 8,650 dong with the highest trading volume in the past 2 months. HTN of Hung Thinh Incons also hit the ceiling. Some codes like SAM increased 4.6%, DIG gained 3.7% or DRH gained 3.3%…

Today is a trading session with the participation of foreign ETFs due to the time of restructuring, so foreigninvestors’ transactions are relatively active. They bought 3,482 billion and sold 3,711 billion, equivalent to a net selling of 229 billion dong on HoSE.

The codes that were bought the most were STB (278 billion), VJC (123 billion) and VRE (109 billion). On the contrary, the codes that were sold the most were still forgotten like MSN (-236 billion), VNM (-151 billion) and VIC (-149 billion).

Market liquidity accordingly increased sharply due to exciting movements from foreign ETFs. The total matched value increased by more than 20% compared to the previous session to 27,674 billion dong , of which the matched value on HoSE alone increased by 18% to over 23,300 billion dong .

In international markets, US stocks yesterday also gained for the third consecutive session. Dow Jones gained nearly 418 points (1.23%) to end the session at 34,481 points. The S&P 500 Index also gained 1.23%, the Nasdaq Composite added 1.22%.

Similarly, the MSCI Asia-Pacific Index excluding Japan increased by 3.98%. The Nikkei 225 gained 3.46% and the Topix gained 2.47% in Japan.

Brent oil futures rose $8.62 , or 8.79%, to $106.64 per barrel. WTI oil futures prices increased by $7.94 , or 8.35%, to $102.98 per barrel.

Source: Zingnews.vn

Source: Vietnam Insider