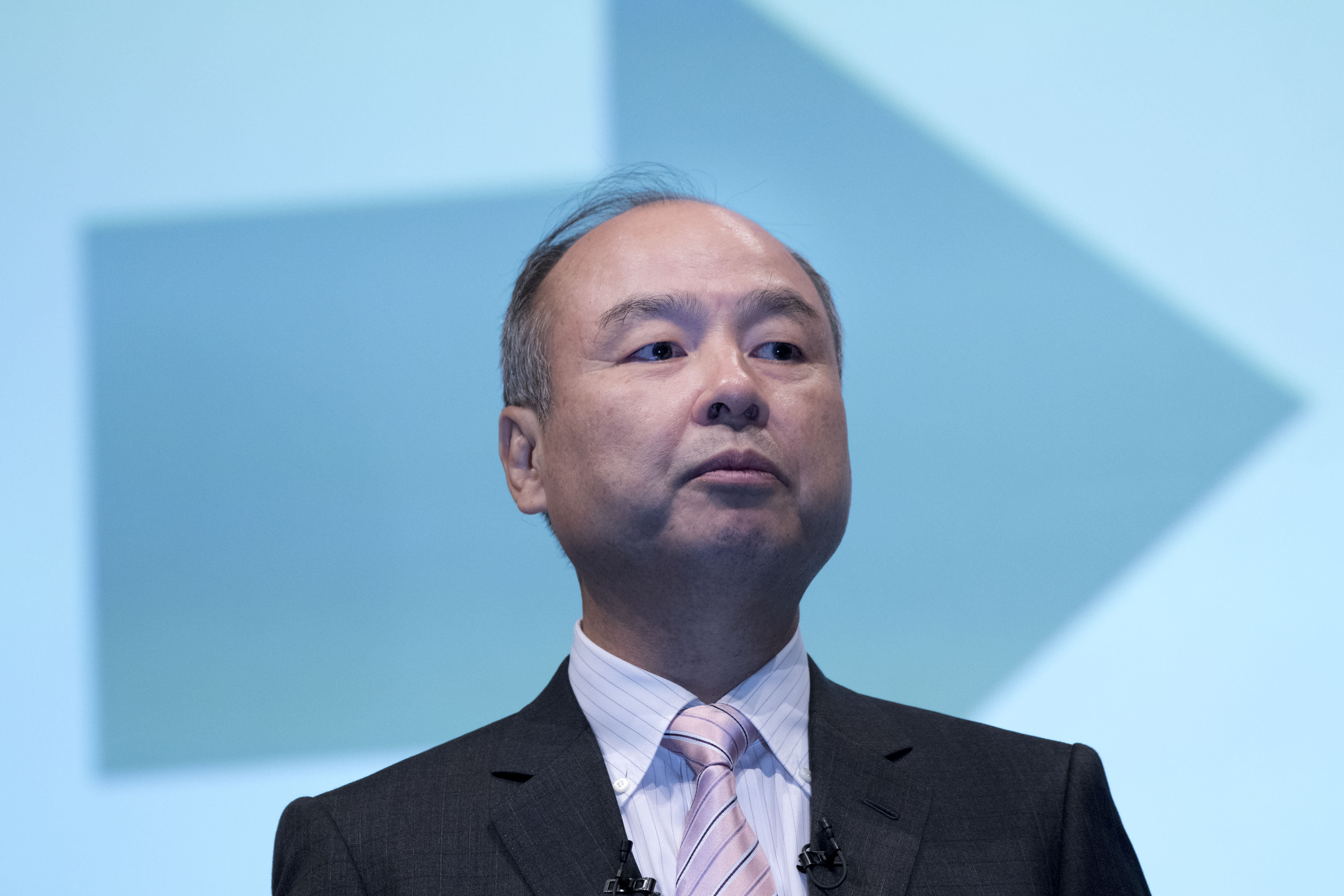

Masayoshi Son speaks during a joint announcement with Toyota Motor to make new venture to develop mobility services in Tokyo in October 2018.

Alessandro Di Ciommo | NurPhoto | Getty Images

SoftBank has offloaded shares of U.S. tech giants like Facebook, Microsoft, Alphabet and Netflix, according to its latest financial report released on Tuesday.

The Tokyo-headquartered conglomerate invests in publicly listed shares through its SB Northstar trading unit and it provides a breakdown of the unit’s portfolio companies in its quarterly results.

Facebook, Microsoft, Alphabet and Netflix were included in SB Northstar’s portfolio at the end of March, but they were absent from the list at the end of the April-June quarter, suggesting a reduction or a complete offload in holdings.

At the end of March, SoftBank had $3.1 billion of Facebook shares, $1 billion of Microsoft shares, $575 million of Alphabet shares and $382 million of Netflix shares. But all four were unlisted in its June report.

SoftBank reduced the size of its stake in Amazon from $6.2 billion to $5.6 billion, according to the filings.

In total, SB Northstar held stakes in firms worth $13.6 billion at the end of June, down from $19 billion at the end of March.

A SoftBank spokesperson pointed CNBC to the filings when asked about the offload of tech stocks, but declined to comment further.

Last September, The Financial Times reported that SoftBank was the mystery “Nasdaq whale” buying billions of dollars in call options — which bet on stocks rising.

The report quoted a source saying SoftBank had been snapping up options in major tech names like Tesla, Amazon, Microsoft and Netflix, potentially driving up valuations in the sector. SoftBank declined to comment on the report at the time.

SoftBank’s overall net profit for its fiscal first quarter fell 39% year-on-year to 762 billion Japanese yen ($6.9 billion) as Chinese regulators cracked down on Alibaba, its biggest bet, and other companies in the portfolio like Didi.

The SoftBank Vision Fund, a dedicated tech investment fund, posted a $2.1 billion profit as companies in the portfolio listed on stock markets.

Source: CNBC